If you’re looking to take on a major home renovation or new construction project you’ll likely need to get financing to cover the costs. Two popular options for funding these types of projects are home equity loans and construction loans. But which one is the better choice for your situation? This comprehensive guide examines the key differences between home equity loans and construction loans to help you decide.

Overview of Home Equity Loans

A home equity loan allows you to borrow money against the equity you’ve built up in your home Equity is the difference between your home’s current market value and the amount you still owe on your mortgage

For example, if your home is worth $300,000 and you owe $180,000 on your mortgage, you have $120,000 in equity ($300,000 – $180,000) With a home equity loan, you can tap into that equity to get a lump sum of cash, up to a certain percentage of your total equity

The benefits of a home equity loan include:

-

Low interest rates: Home equity loans typically have lower interest rates than other financing options like personal loans or credit cards. The rates are low because the loan is secured by your home.

-

Fixed payments: Home equity loans have fixed monthly payments, so you know exactly what to budget each month.

-

Fast funding: You can often get funds from a home equity loan within a couple weeks of applying.

-

Tax benefits: Depending on how you use the funds, the interest may be tax deductible. Check with your tax advisor.

The potential downsides are:

-

Closing costs: Expect to pay 2-5% of the loan amount in upfront fees like appraisal and origination costs.

-

Home is collateral: If you default, the lender can foreclose and force a sale of your home to recoup the loan.

-

Limit on loan amount: Most lenders will only lend up to 80-85% of your total equity.

Overview of Construction Loans

A construction loan is specifically designed to finance building a new home or completing major renovations. With this type of financing, the lender provides funds on a draw schedule to pay contractors and suppliers during the construction period.

There are a few varieties of construction loans:

-

Construction-to-permanent: The loan converts to a regular mortgage once construction is finished. This avoids a second closing.

-

Construction-only: The loan must be paid off after the build. You’ll need separate financing for the mortgage.

-

Renovation loan: A construction loan for remodeling an existing property rather than new construction.

Benefits of construction loans include:

-

Fund major projects: Construction loans allow you to take on bigger projects.

-

Pay-as-you-go: Interest accrues only on the funds drawn, not the full amount.

-

One-time close: With a construction-to-permanent loan you only close once.

Potential drawbacks include:

-

Short terms: Expect terms of 6-24 months. The loan must be refinanced or paid off when the project is done.

-

Variable rates: The interest rate may start low but then fluctuate during the loan.

-

Strict approval: You’ll need excellent credit, plans, permits, and a proven contractor.

-

No guarantees: The lender may not fund the full project costs.

Key Differences Between the Loan Types

Now that you understand the basics of each loan type, let’s look at some of the key differences:

Loan Amount

-

Home equity loan – You can borrow up to 80-85% of your home equity, depending on the lender. If you don’t have enough equity, you may not qualify for the amount you need.

-

Construction loan – Approved based on the total projected costs of the construction project, not your equity. Allows you to take on bigger projects.

Interest Rates

-

Home equity loan – Usually fixed around 5-6% for the life of the loan. Lower rates than unsecured options.

-

Construction loan – Often start with a low teaser rate then fluctuate. Expect rates of 5-8% but could go higher if benchmarks rise.

Fees

-

Home equity loan – Closing costs are 2-5% of the loan amount. Lower than mortgage closing costs.

-

Construction loan – Expect to pay 3-5% of the loan amount in fees for things like the appraisal and loan origination.

Payments

-

Home equity loan – Fixed principal and interest payments. You owe payments every month once funded.

-

Construction loan – Only interest payments may be due during the construction. Principal isn’t owed until project completion.

Collateral and Risk

-

Home equity loan – Your home secures the loan, but lenders can still foreclose if you default.

-

Construction loan – Unfinished construction is used as collateral. Weak collateral means higher risk of denial.

Credit Score Needed

-

Home equity loan – A minimum credit score around 620 is typical, though better scores get better rates.

-

Construction loan – Expect to need a score of at least 720. Anything below 700 will be a very hard sell.

Loan Term

-

Home equity loan – Repayment terms of 10-30 years are common.

-

Construction loan – Very short terms of 6-24 months are standard.

Which Is Better for Home Renovations?

Whether a home equity loan or construction loan works better for funding your home improvement project depends on your specific situation and needs.

Home Equity Loans Are Best If:

- You have enough home equity to qualify for the loan amount you need

- You want low fixed interest rates and predictable payments

- You don’t need funds immediately and can wait a few weeks

- Your credit score is at least 620

Construction Loans Are Best If:

- You have limited home equity available to tap

- You need to finance a very large or expensive project

- You want to build a new home, not just remodel

- You want to lock in a low teaser interest rate

- You have great credit (720+ score)

In some cases, a combination of the two loans may make sense. You could use a construction loan for the bulk of the project costs, then tap a home equity line of credit for finishing touches and unexpected overages.

Tips for Choosing the Right Loan

If you’re still unsure which loan is best for your next home renovation, keep these tips in mind:

-

Shop rates from multiple lenders for both loan types. Compare costs.

-

Be realistic about your home’s value. Get an appraisal to confirm your equity.

-

Prioritize must-have renovations and save extras for later phases.

-

Consult your contractor for the true project costs and get a detailed construction plan.

-

Calculate your total monthly payments including your existing mortgage and debts.

-

Examine your credit report and scores to address any issues ahead of time.

-

Build up savings to cover closing costs, unexpected delays and cost overages.

-

Understand all fees, draw schedules, and risks before committing to a construction loan.

Alternatives to Consider

If you find that neither a home equity loan nor construction loan fit your needs, here are a few other options worth considering:

Cash-Out Refinance

If you have sufficient equity, you may be able to do a cash-out refinance to tap equity. This essentially replaces your current mortgage with a bigger one. The funds get paid out to you in a lump sum.

401(k) or Retirement Fund Loan

Some 401(k) and 403(b) plans allow you to borrow against your own retirement savings. This isn’t ideal, but if done as a short-term loan it may help bridge a remodeling gap.

Personal Loans

Unsecured personal loans don’t require collateral and have fixed payments like a home equity loan. But interest rates are higher and large loans above $15-20k are hard to get.

Credit Cards

Putting remodeling charges on a credit card should really be a last resort due to very high interest costs, but 0% intro APR offers can make this practical for smaller projects. Just be sure to pay the balance before rates surge.

Home Improvement Grants

Government agencies, nonprofits, and even some utility companies offer grants to make home improvements more energy efficient. These are limited but worth exploring.

Signature/Co-signed Loans

If your credit is poor, having a cosigner with good credit may help you qualify for an unsecured personal loan to fund home improvements. But make sure you can afford the payments.

The Bottom Line

There’s no one-size-fits-all solution for funding home renovations. Take time to weigh the pros, cons, costs, and risks of both home equity loans and construction loans. Understanding what each entails will empower you to choose the most strategic financing approach.

With prudent planning, discipline

Tailored Financing with Construction Loans

Construction loans are short-term financing solutions that cater specifically to construction and major renovation projects. They provide funds in stages, aligning with the project’s progress, which can be beneficial for managing cash flow. One such option is the Fannie Mae HomeStyle Renovation loan, which offers competitive rates and can be used for various renovation projects. For more information, Fannie Mae’s HomeStyle Renovation page provides detailed insights.

Comparing the Financial Details

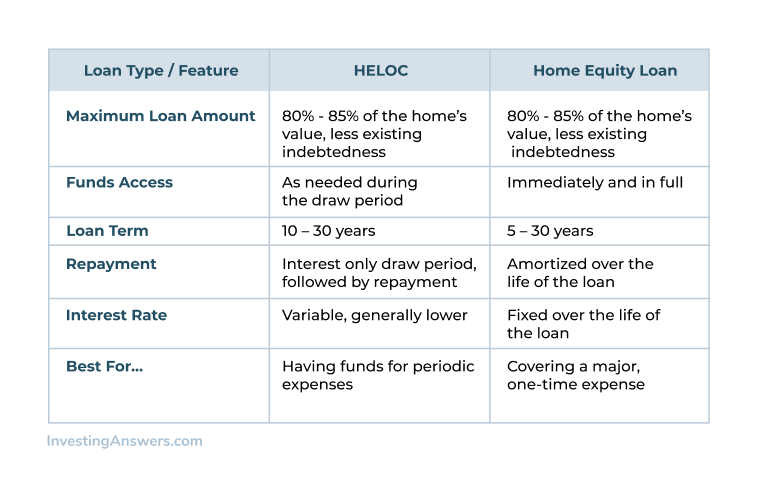

To aid in your decision-making, consider the following table that contrasts key aspects of construction loans and HELOCs:

| Construction Loan | HELOC | |

|---|---|---|

| Interest Rates | Typically fixed | Usually variable |

| Funding Structure | Draws during construction | As-needed basis |

| Collateral | Future value of the project | Present home equity |

| Loan Term | Short-term, converts to mortgage | Revolving with draw period |

For veterans, VA-backed cash-out refinance loans offer additional benefits and can be explored on the VA’s official site.

HELOC Vs Home Equity Loan: Which is Better?

Is a HELOC better than a construction loan?

HELOCs often have lower closing costs than construction loans as well. If you have adequate home equity for a HELOC to fund your project but want the fixed interest rate and fixed monthly payments that the construction loan would have, a home equity loan may be a third option.

What is the difference between home equity and construction loans?

“Home equity loans are based on your home’s current equity, while construction loans are based on the future value of the home; [it’s] financing based on the new-home value when the construction is done,” Melissa Cohn, regional vice president of William Raveis Mortgage, told The Balance by phone.

What is the difference between a mortgage and a construction loan?

A mortgage is backed by the value of the existing home. With a construction loan, however, the home or home improvements don’t exist yet. The lender needs firm evidence that the project will not only be completed but in the case of a renovation, will add value to the home.

How do home equity lines of credit & construction loans work?

Financing a major home renovation or new home construction requires a lender to evaluate risk on a residence that doesn’t yet exist or have a particular valuation. Two different loan products, home equity lines of credit (HELOCs) and construction loans, help borrowers get the construction funds they need through different means.