Taxes may not be the most exciting thing youll ever do, but if you have a personal loan, knowing the potential tax implications can help when it comes time to file your return.

The good news: There is no set personal loan tax. However, knowing when and how a personal loan might impact your taxes can help ensure you don’t miss out on any potential deductions. Here is what you need to know:

Taking out a personal loan can help you pay for major expenses like home renovations medical bills or consolidating high-interest debt. But when tax time rolls around, many borrowers wonder – can I deduct the interest I paid on my personal loan?

The short answer is no, in most cases personal loan interest is not tax deductible. However, there are some exceptions and strategies that may allow you to deduct at least a portion of the interest you paid.

Why Personal Loan Interest Isn’t Normally Tax Deductible

According to the IRS, you can only deduct interest expenses on a loan if the borrowed money was used to purchase or carry investment property. This is known as investment interest.

Personal loans don’t fall into this category The IRS considers money borrowed for personal reasons like paying off credit card debt, financing a vacation, or covering medical bills to be personal interest And personal interest is never tax deductible.

There are only a few types of personal interest that you can deduct:

- Mortgage interest on your primary residence and second homes

- Student loan interest

- Interest on loans secured by investment property

So if you took out a personal loan to remodel your kitchen or pay off wedding expenses, you won’t be able to deduct the interest when you file your tax return.

When Personal Loan Interest May Be Partially Deductible

While it’s rare, there are some cases where you may be able to deduct a portion of the interest paid on a personal loan:

Mixed-Use Loans

If you used the proceeds from a personal loan for both personal and business expenses, it’s considered a mixed-use loan.

For example, let’s say you took out a $20,000 personal loan. You used $15,000 to consolidate credit card debt and $5,000 to purchase equipment for your side business.

In this case, you may be able to deduct the interest on the $5,000 that was used for business purposes. You’ll need to calculate the business portion of the interest and claim it as a business expense on Schedule C.

Home Equity Loans

Home equity loans and lines of credit are another type of mixed-use loan. If you borrow against your home’s equity, you can only deduct the interest in certain circumstances:

- The total of all your home loans is less than $750,000 ($375,000 if married filing separately)

- You used the loan proceeds to buy, build, or substantially improve your home

So if you took out a $50,000 home equity loan to remodel your kitchen, you could potentially deduct that interest. But if you used the money to pay off credit card bills, the interest wouldn’t be deductible.

Loan to Purchase Small Business Stock

Interest paid on a loan used to purchase small business stock may be deductible if certain conditions are met. The business must be a domestic C corporation with less than $50 million in assets when the stock is issued. And you must hold the stock for at least 5 years.

Strategies to Deduct Personal Loan Interest

While personal loan interest isn’t directly deductible in most cases, there are a couple strategies you could use to potentially deduct at least some of the interest:

Refinance with a Mortgage or Home Equity Loan

If you have sufficient equity, you may be able to pay off your personal loan by refinancing into a mortgage or home equity loan. This would convert your non-deductible personal interest into deductible mortgage interest.

Just keep in mind, there are costs associated with refinancing that may outweigh the potential tax savings. And your total mortgage debt must remain under the limits mentioned earlier to deduct the interest.

Use the Interest to Earn Taxable Income

Even though you can’t directly deduct personal loan interest, you may be able to indirectly deduct it by using the loan proceeds in a way that generates taxable income.

For example, you could use a personal loan to invest in a rental property. While you can’t deduct the interest directly, the rental income would be taxable. You can then use that income to absorb the interest deduction and lower your tax liability.

This strategy works best if you expect the investment to generate significant taxable earnings. The income has to be high enough to offset both the interest and taxes due on the earnings.

The Bottom Line

Personal loans can be extremely helpful for managing major expenses and consolidating high interest rate debt. Just don’t expect to deduct the interest paid when you file your taxes.

In very limited cases, you may be able to deduct a portion of the interest on a mixed-use or home equity loan. And there are some strategic workarounds that could effectively achieve a similar tax benefit.

But for most borrowers, the interest paid on a standard personal loan won’t directly reduce your taxable income. As long as you understand that upfront, a personal loan can still be a smart financing choice when used carefully and responsibly.

Frequently Asked Questions

Can I deduct interest on a loan from friends or family?

No, you cannot deduct interest paid on a loan from friends or family. The IRS considers this personal interest, which is not tax deductible.

The only exception is if the loan was used for business purposes or to earn investment income. The interest may then be deductible as a business or investment expense.

What if I used the loan to pay medical bills?

Unfortunately, even if you used a personal loan to pay medical bills, the interest is still not deductible. The IRS does not make exceptions for medical expenses or emergencies.

The only option would be if you used a home equity loan to pay the medical bills. You may then be able to deduct a portion of the interest.

Can I deduct interest on loans against my 401(k) or life insurance?

In most cases, no. The IRS considers borrowing against your 401(k) plan or life insurance policy to be the same as taking out a personal loan.

The only way the interest may be deductible is if you used the borrowed money solely for investment purposes.

What if I used the loan to buy a car for business?

If you used a personal loan specifically to purchase a vehicle for your business, the interest may be deductible as a business expense.

You’ll need to calculate the business use percentage and apply that to the interest paid. For example, if you use the car 50% for business, you can deduct 50% of the interest.

Be sure to keep detailed mileage logs proving the vehicle’s business vs. personal use.

Even when allowed, only interest is tax deductible

Some types of loans can qualify for a tax deduction. But generally, you can deduct only the interest portion you pay on the loan (and sometimes origination fees in the case of student loans, for example), not the loan amount.

4 Types of Loans With Tax Deductible Interest

You can get a tax deductible interest on certain types of loans if you meet all the criteria. Here are a few examples of loans that may qualify for for a tax deductible interest:

If you took out student loans for qualified higher education expenses, you may be able to deduct up to $2,500 in interest payments each year. For the interest deduction, qualified expenses may include tuition, fees, lodging, textbooks, and other necessary expenses. The definition varies for certain higher education tax credits.

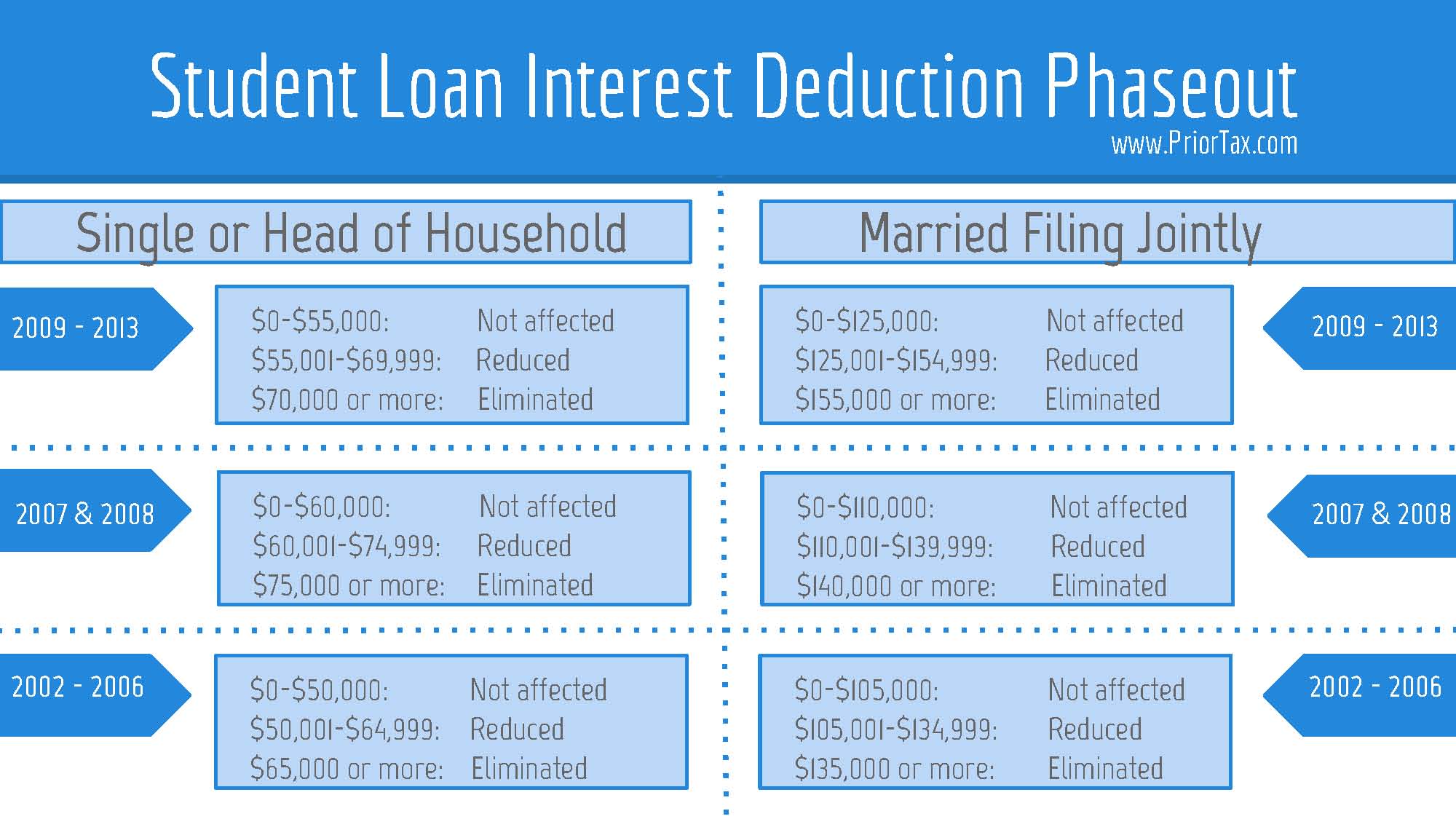

You can take this deduction even if you don’t itemize. However, you can’t take the deduction if you use the married filing separately status or if someone can claim you or your spouse as a dependent. The deduction also phases out based on your modified adjusted gross income.

While the Tax Cuts and Jobs Act of 2017 created new rules for deducting mortgage interest payments, it didn’t get rid of the deduction altogether. Individuals can still deduct interest on mortgages when they use the money to buy, build, or improve a home. If you paid mortgage interest points, those payments can also be deductible. In both cases, if you qualify, you must itemize your deductions to benefit.

The law did limit how much interest you may be able to deduct. Now, you can deduct interest on up to $375,000 worth of mortgage debt (or, $750,000 if you’re married and file jointly). Higher limits of $500,000 and $1,000,000 apply if you took out the mortgage before Dec. 16, 2016.

Interest payments on second mortgages, such as a home equity loan (HEL) or home equity line of credit (HELOC) may also be deductible. However, the mortgage value limit applies to the combined balance of your first and second mortgages.

To qualify, you need to use the proceeds from the loan to substantially improve the home by increasing its value or extending its life. In other words, building an addition might qualify, but making purely cosmetic changes that don’t increase its value wouldn’t.