While we always want to make our monthly mortgage payments, sometimes life can get in the way. If youâre in need of mortgage assistance, there are options available. One of those options involves writing a financial hardship letter. A financial hardship letter is a written document for your lender explaining why youâre unable to meet your financial obligations. Letâs learn more about how these letters work, when to use them and how to write an effective letter.

Falling behind on your mortgage payments can happen to anyone. Job loss, medical bills, divorce – life throws curveballs that can impact your finances. If you find yourself struggling to pay your mortgage, requesting a loan modification from your lender should be a top priority.

A well-written mortgage hardship letter is crucial to this process. This personal letter to your lender explains your situation and requests their assistance in modifying your loan terms to avoid foreclosure.

In this comprehensive guide, we provide tips and sample language to help you compose an effective hardship letter customized to your unique situation. We’ll cover:

- What to include in your letter

- Convincing lenders with your plan

- Writing tips and formatting

- Sample letters and templates

Let’s get started on how to give yourself the best shot at mortgage relief with a compelling hardship letter!

What is a Mortgage Hardship Letter?

Also called a financial hardship letter this personal letter to your mortgage lender requests a modification of your loan terms to make payments affordable based on extenuating financial circumstances.

You must send this letter, along with required financial docs to be considered for options like

- Lower interest rate

- Extended repayment term

- Switching to an adjustable rate

- Reduced principal balance

- Temporary reduction in payments

The letter provides the background and context of your situation that prompts the request for mortgage relief, Think of it as telling your financial story directly to the lender and asking for their help

When Do You Need a Hardship Letter?

If you’ve experienced an involuntary hardship leading to missed mortgage payments, a personalized letter should be sent along with your application for mortgage assistance.

Common situations requiring a hardship letter include:

- Unemployment or reduced wages

- Major medical expenses

- Divorce or death of a spouse

- Disability or illness

- Increased housing expenses

- Business failure or loss of self-employment income

The letter acts as your formal request and explanation for the lender to modify unaffordable loan terms.

What to Include in Your Mortgage Hardship Letter

Though you’ll want to customize your letter based on your particular situation, here are some standard elements to include:

Identifying Information

Include your full name, property address, mortgage account number, and contact information at the top. Make it easy for the lender to identify you and pull up your account.

Explanation of Hardship

Briefly explain the circumstances that led to your financial hardship and need for mortgage relief. Being specific but concise helps gain the lender’s understanding and sympathy.

Common hardships include job loss, medical problems, death in family, divorce, disability, etc. Provide relevant details without including overly personal information.

Supporting Documentation

Mention that you’ve included supporting documents with your letter, such as financial statements, hardship evidence like medical bills or layoff notice, tax returns, bank records, etc.

Plan to Get Repayment Back on Track

Explain your plan to resolve the delinquency if the lender grants your request for modified mortgage terms. Provide details like future changes in income, when you will likely resume full payments, and the specific assistance you are requesting.

Request for Specific Relief

Ask the lender for the specific solution you are seeking, based on your financial analysis. Common requests include:

- Lower interest rate

- Extended loan term

- Switch to adjustable rate

- Temporary reduction in payments

Be clear and reasonable in what you are asking of the lender.

Expression of Good Faith

Include a statement showing you want to work with the lender in good faith to get your payments back on track. Highlight any past on-time payments or funds you have set aside as a show of good faith.

Contact Information and Signature

Include your preferred contact method and best times to be reached to discuss your request. Sign the letter with your full legal name.

Formatting Tips

-

Address the letter to a specific person or department at the mortgage company. This ensures it gets properly routed.

-

Keep the letter 1-2 pages max. Lenders have many letters to review so be concise.

-

Use a professional letter format with your address and the lender’s address, a proper salutation, clear organization, and closing.

-

Print and sign the letter in blue or black ink. Then send by certified mail with tracking to confirm delivery.

-

Save a copy of the final letter along with any supporting documents for your records.

Sample Mortgage Hardship Letters

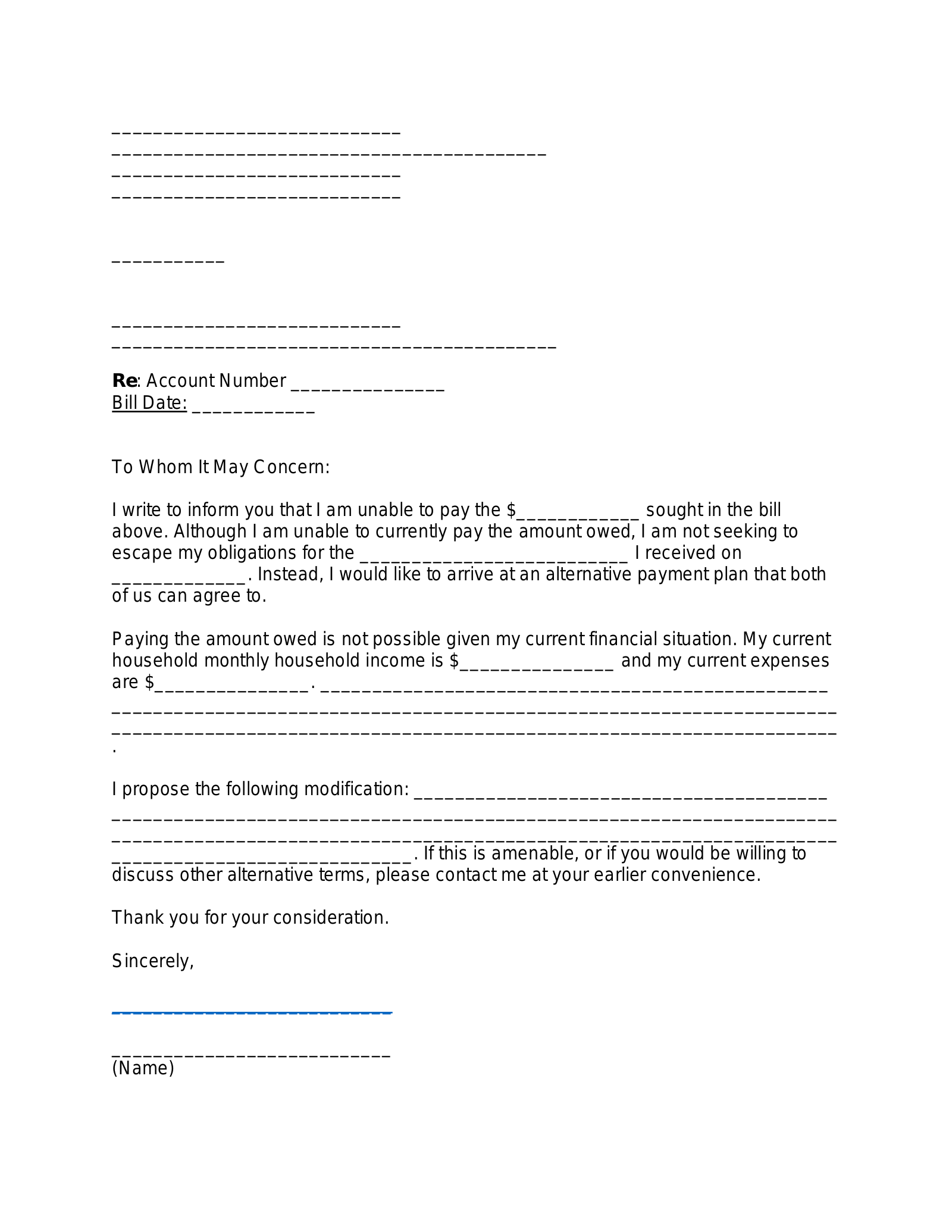

While your hardship letter must be unique to your situation, reviewing example letters can help provide ideas and template language as you craft your own:

Unemployment Hardship Letter Example

Date

John Smith

123 Main St

City, State, Zip

ABC Mortgage Company

Loan Servicing Dept.

987 Oak Rd.

City, State, Zip

Dear Mr. Smith,

I am requesting mortgage relief options from ABC Mortgage Company for my home loan ending in 1234. Due to COVID-19, I was laid off from my job as a chef at the end of February 2022. Despite extensive efforts, I have been unable to secure new employment within the restaurant industry following the economic slowdown.

This loss of my sole income has prevented me from making full mortgage payments for the past four months. I am requesting that my mortgage interest rate be reduced from 5% to 3% for the next 12 months until I can secure a new job. I have attached documentation of my unemployment status, job search efforts, bank statements, and other financial records.

Prior to the pandemic, I never missed a payment over my 7 years with ABC Mortgage. I want to continue paying to the best of my ability during this difficult time. In addition to a reduced interest rate, I am also asking to extend the repayment period from 15 years remaining to 20 years.

Please contact me at [phone] or [email] to discuss my hardship situation further. I appreciate your assistance and look forward to finding a mutual solution.

Sincerely,

[Your name and signature]

Medical Hardship Letter Example

Date

Jane Doe

321 Pine Road

City, State, Zip

XYZ Mortgage Inc.

Loan Modification Dept.

54 South St

City, State, Zip

Dear Ms. Doe,

I am writing regarding my request for mortgage relief for my loan ending in 3452. Over the past year, my husband John has been diagnosed and undergone treatment for stage 4 lung cancer.

The extensive medical bills related to his diagnosis, surgery, chemotherapy, and upcoming radiation have exhausted nearly all our savings and led me to miss the last 3 mortgage payments. I have attached our medical records, payment history, bank statements, and other financial documentation for your review.

John has one month of treatment remaining. Once he is in recovery, I will be able to increase my hours again working as a teacher. However, I am requesting that the principal balance be reduced from $2,500 to $2,000 and the interest rate lowered from 4.5% to 3.2% for the next 24 months to make payments affordable.

We have lived in this home for over a decade and keeping our home is essential during this difficult period to maintain stability for our family. Please reach out to me at [phone] or [email] so we can discuss a loan modification to get back on track. I appreciate your assistance.

Sincerely,

[Your name and signature]

Seeking Legal or Financial Advice

Consider consulting foreclosure defense counsel or a financial advisor as you navigate this process. They can review your situation, help compose your letter, and ensure you submit a complete assistance application. This can increase your chances of the lender approving your modification request.

The bottom line is that a compelling hardship letter is vital to start a dialog with lenders and show them you deserve mortgage relief. Use this guide to craft your personalized story and request modified terms during difficult financial times. With a bit of effort, you can improve your chances of mortgage assistance and avoid foreclosure.

What Is A Financial Hardship Letter?

A financial hardship letter is a document in which you can detail your financial situation for your lender in hopes of getting a payment extension or reduction.

This letter should explain your current financial situation and why youâre unable to make payments. It should provide specific details about the hardship, such as when it began, how it was caused and how long it may continue.

See What You Qualify For

A financial hardship letter may be needed when unfortunate events outside of your control keep you from being able to pay your mortgage. This letter aims to let the lender know why you havenât been able to make payments. Some examples of situations your mortgage lender may consider a financial hardship include:

- Serious illness or injury that results in extensive medical expenses

- Natural or man-made disaster

- Death

- Military deployment

- Incarceration

- Sudden reduction of income

- Job relocation or layoff

- Divorce or legal separation

How To Write A Hardship Letter for Loan Modification Step by Step Guide | Writing Practices

FAQ

What is considered a hardship for a loan modification?

What is an example of a good hardship letter?

What is a mortgage financial hardship letter?

Create a high-quality document now! A mortgage financial hardship letter requests a lender for loss mitigation on a mortgage loan — such as a loan modification for a reduction in payments or a short sale — due to extenuating financial circumstances.

How do I write a hardship letter for a loan modification?

A foreclosure attorney can assist you with writing this letter and will submit it along with your other financial documents, so that they can present the strongest possible case to your lender. When writing a hardship letter for a loan modification, keep in mind that lenders want to know why you have fallen behind with your mortgage payments.

What is a loan modification letter?

This letter is to support our application for a loan modification plan that will help us to get our mortgage payments back on track with an affordable mortgage. We have lived in our home for over 20 years and we want to work hard and keep it. [Explain any special hardship circumstances.

What is a hardship letter?

A hardship letter is a crucial document in the loan modification process, where you explain to your lender the financial difficulties you’re facing and why you need a modification of your loan terms. It’s your opportunity to provide context to your financial situation and persuade the lender to offer more manageable repayment terms.