Editorial disclosure: Our goal is to give you the tools and confidence you need to improve your finances.

The Loan Estimate and Closing Disclosure are two forms that you’ll receive during the home-buying process. The Loan Estimate comes at the beginning, after you apply, while the Closing Disclosure comes at the end before you sign the final paperwork for your mortgage.

Knowing how to interpret these standardized documents will help you get the best loan possible and avoid any unpleasant surprises at closing. Here’s a quick look at how these two forms compare:

Buying a home is an exciting yet stressful process. As a buyer, you have to navigate complex regulations and paperwork to finalize your loan. Two of the most important documents you’ll receive are the Loan Estimate and Closing Disclosure. These forms outline the terms and costs of your mortgage loan.

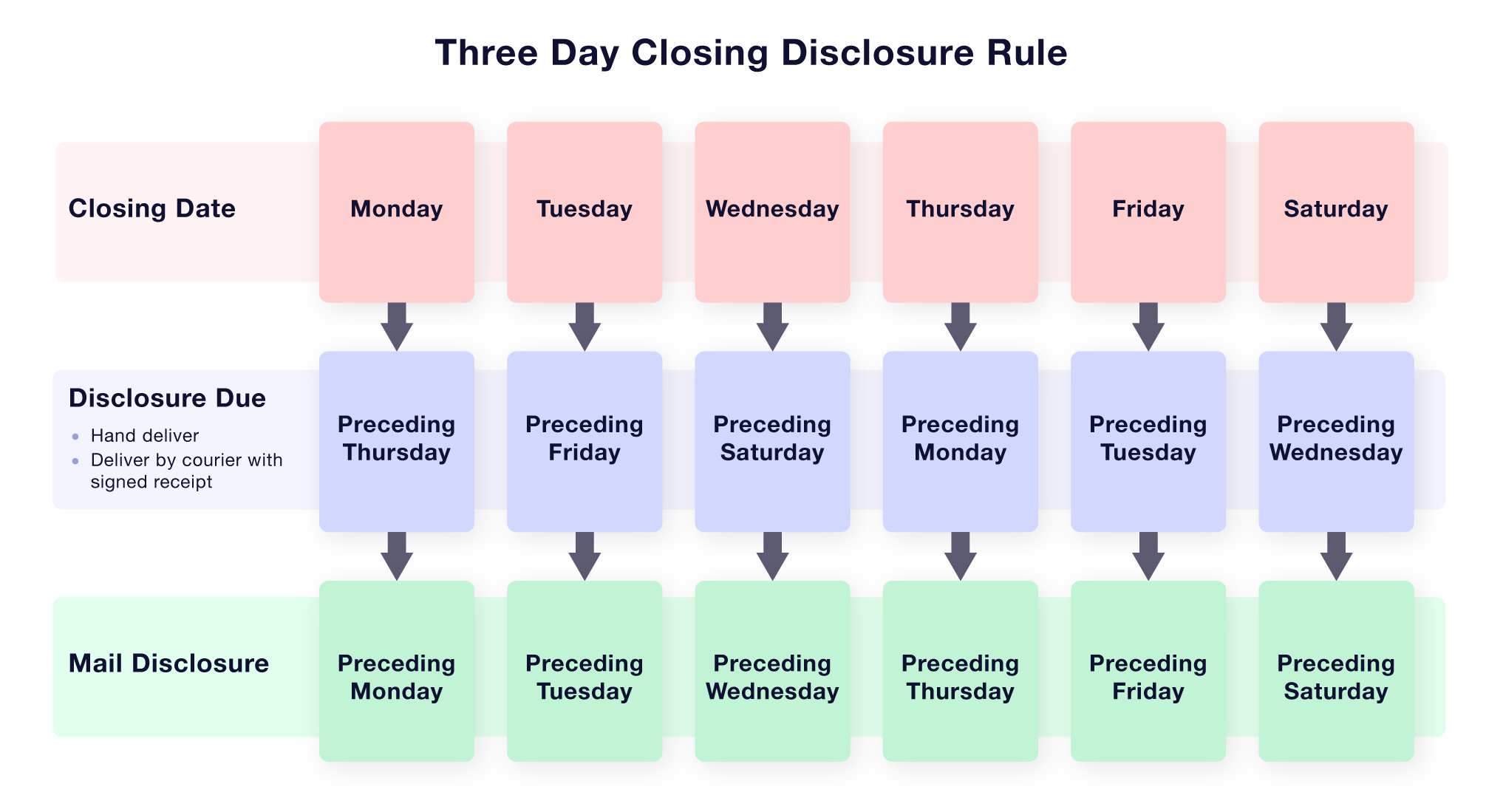

The Loan Estimate provides a summary of your loan terms and estimated closing costs The lender must provide this within 3 business days of your loan application The Closing Disclosure contains your final loan terms and closing costs. This form comes at least 3 business days before closing.

These timelines can seem confusing, especially if issues crop up during the buying process. This article will walk you through the Loan Estimate and Closing Disclosure timeline using a real-world example.

Overview of the Timeline

Here’s a quick summary of the Loan Estimate and Closing Disclosure timeline

-

Day 1: You apply for a mortgage loan.

-

Day 4: The lender sends the Loan Estimate.

-

At least 3 business days before closing: The lender sends the initial Closing Disclosure.

-

Day of closing: You review the final Closing Disclosure at closing.

This timeline ensures you have time to review your loan details and closing costs. Now let’s go through a detailed example.

Walkthrough of the Timeline

Imagine you found your dream home and made an offer on October 5th. The seller accepted the offer, so you applied for a mortgage loan from ABC Lender the same day.

Loan Estimate Delivery

October 5: You completed your loan application with ABC Lender.

October 8 (Day 4): ABC Lender sent the Loan Estimate by mail. The Loan Estimate breaks down your loan terms, projected payments, and estimated closing costs.

Shopping for Your Loan

Over the next month, you shopped around for the best loan option. You decided to stick with ABC Lender because they offered the best interest rate and fees. During this time, ABC Lender ordered an appraisal and credit report.

Changed Circumstances

November 6: The appraisal showed the property value was higher than expected. This meant your loan-to-value ratio exceeded 80%, so mortgage insurance was required.

November 24: ABC Lender pulled your credit again and found your credit score had dropped. This resulted in a higher interest rate.

In both cases, the lender was allowed to issue a revised Loan Estimate due to the changed circumstances. ABC Lender sent the updated Loan Estimate within 3 business days of the new information.

Rate Lock

December 7: You requested to lock your interest rate at 4.25%.

December 11: ABC Lender sent a revised Loan Estimate reflecting the locked rate. Lenders must send an updated Loan Estimate within 3 business days of a rate lock.

Final Closing Disclosure

December 21: You told ABC Lender you wanted to purchase an enhanced title insurance policy, which increased your closing costs.

December 23: ABC Lender overnighted the Closing Disclosure reflecting the updated title insurance premium. To meet the 3-day disclosure requirement, the lender would need to send the Closing Disclosure by December 23 for a December 29 closing.

Walkthrough Issues

December 28: At the walkthrough, you discovered the seller’s dishwasher was broken. The seller agreed to credit $500 toward replacement.

ABC Lender provided a revised Closing Disclosure on December 29 reflecting the $500 credit. Lenders can send a revised Closing Disclosure to reflect walkthrough issues up until the day before closing.

At Closing

December 30: You reviewed the final Closing Disclosure at the closing table. This document shows your final loan terms, closing costs, and cash to close figure.

There were no further changes, so you closed on your home loan! ABC Lender will mail your first mortgage statement within a month after closing.

Key Takeaways

Walking through this detailed example highlights key points about the Loan Estimate and Closing Disclosure timeline:

-

Shop around: You can shop for your loan after receiving the Loan Estimate. Compare Loan Estimates from multiple lenders.

-

** documents:** The lender can revise the Loan Estimate for valid changed circumstances like a new appraisal or credit score. You will receive a new Closing Disclosure if costs change.

-

Closing Disclosure timing: You must get the final Closing Disclosure at least 3 business days before closing. This gives you time to review the terms.

-

Walkthrough fixes: Your lender can provide a revised Closing Disclosure to reflect walkthrough repairs up until 24 hours before closing.

Understanding these timeframes helps you know what to expect during the homebuying process. If you don’t receive the Loan Estimate or Closing Disclosure at the right time, contact your loan officer immediately. Ask questions if you’re confused about any changes to your loan terms or closing costs.

With a complex process like buying a home, knowledge is power! Following the loan estimate and closing disclosure timeline ensures you have sufficient time to review your loan and close on your dream home.

What is a Closing Disclosure?

The Closing Disclosure is a five-page form that presents all the information found in the Loan Estimate but in a finalized form. It shows how much you’ll actually pay if you go through with closing and take on the loan.

Tip:

To keep your lender honest, compare your Loan Estimate from the same lender to your Closing Disclosure to make sure all the key terms of your loan are as expected.

Comparing lenders using your Loan Estimate

Loan Estimates make it easy to compare the interest rates and fees different lenders have offered you. Here’s the information you’ll find on the second and third pages of your Loan Estimate.

Page 2

This page contains an itemized list of every closing cost you’ll pay, along with an estimate of how much cash you’ll need to close. One of the biggest fees is the origination charge. It consists of the lender’s fee to process and underwrite your loan, plus any discount points you choose to pay to lower your interest rate. It’s typical to pay around 1% of the loan amount in origination charges.

This page also shows “Services You Cannot Shop For.” These are closing costs that are determined by the lender or by law, such as the appraisal fee, credit report fee, and flood determination fee.

Page 3

This page of the Loan Estimate contains a “Comparisons” section. It shows how much the loan will cost you during the first five years and how much of that cost will go toward the loan principal. The loan’s APR is listed here as well.

Finally, the section also shows the total interest percentage (TIP), which tells you how much interest you’ll pay as a percentage of the loan amount if you keep your loan until it’s paid off.

Example:

If your loan amount is $200,000 and the TIP is 60%, then you’ll pay $120,000 in interest over your loan term. The shorter your loan term and the lower your interest rate, the lower your TIP will be.

Credible makes getting a mortgage easy

Checking rates won’t affect your credit score

Loan Estimate and Closing Disclosure Walk Through

FAQ

What is the 7 day rule for loan estimate?

What is the time frame for loan estimate and closing disclosure?

|

Document

|

When you get it

|

What it shows

|

|

Loan Estimate

|

Within 3 business days after applying for a loan

|

Estimated loan terms and costs

|

|

Closing Disclosure

|

At least 3 business days before closing your loan

|

Final loan terms and costs

|

How many days between le and CD?

Can a loan estimate be sent after a closing disclosure?

What is a loan estimate & Closing Disclosure?

The forms also provide more information to help consumers decide whether they can afford the loan and to compare the cost of different loan offers, including the cost of the loans over time. The Loan Estimate and Closing Disclosure must be used for most closed-end consumer mortgages secured by real property or a cooperative unit.

When should a consumer receive a Closing Disclosure?

Consumers must receive the Closing Disclosure no later than three business days before consummation of their loan. The forms use clear language and design to make it easier for consumers to locate key information, such as interest rate, monthly payments, and costs to close the loan.

What is a Closing Disclosure?

A Closing Disclosure is a five-page form providing final details about the mortgage loan you’ve selected. When will you receive it? At least three business days before you’re scheduled to close on your mortgage loan. Why is it important? It provides you with the actual costs of the mortgage loan you’ve selected, including:

When should a loan estimate be provided?

The Loan Estimate must be provided to consumers no later than three business days after they submit a loan application. The second form (Closing Disclosure) is designed to provide disclosures that will be helpful to consumers in understanding all of the costs of the transaction.