Taking out a mortgage and buying a home often isn’t something you can do entirely on your own. If you’re looking to buy a home and need some support, a co-borrower or cosigner may be able to help. With the help of a loan officer, you’ll be able to find which one is fit for your financial and mortgage needs.

Whether you’re looking for someone to share financial responsibilities with, a boost in your mortgage candidacy or someone to fall back on in the event of financial hardship, a co-borrower or cosigner can help.

Keep in mind: If you decide a co-borrower or cosigner is of interest to you, you’ll want to align with the other party and prepare all necessary documents prior to your mortgage application journey.

Buying a home is an exciting milestone in life. However, for many people, qualifying for a mortgage loan on their own can be challenging Having a low credit score, high debt, or insufficient income are common obstacles to homeownership If this sounds familiar, you may want to consider adding a co-borrower to your mortgage application.

But what exactly is a co-borrower? How does the process work? And is it the right option for you? This comprehensive guide will explain everything you need to know about co-borrowers on mortgage loans.

What is a Co-Borrower?

A co-borrower is any additional borrower whose name appears on the mortgage loan documents, in addition to the primary borrower. Their income, assets, credit history and debts are used to qualify for the mortgage loan.

Essentially, the co-borrower shares responsibility for the debt with the primary borrower. Both parties are equally obligated to repay the mortgage loan. If one party defaults the other is still responsible.

For mortgages, the co-borrower’s name also appears on the property’s title as a co-owner. They have equal rights and ownership in the home.

How Does Having a Co-Borrower Help?

There are a few key ways that adding a co-borrower can benefit mortgage qualification:

-

Improved debt-to-income ratio: With another income factored in, your total monthly income increases. This lowers your debt-to-income ratio and allows you to qualify for more home.

-

Higher credit score: If your co-borrower has strong credit, it can offset challenges on your credit report and boost the averaged score used for approval.

-

Added down payment funds: Your co-borrower can contribute funds towards the down payment and closing costs, making the burden easier to handle.

-

Mortgage payment support: If money gets tight, your co-borrower can help cover all or part of the monthly mortgage payments. Their income provides a safety net.

For many homebuyers, having a co-borrower is the difference between qualifying or not qualifying at all. It opens doors to homeownership.

Co-Borrower vs Co-Signer: What’s the Difference?

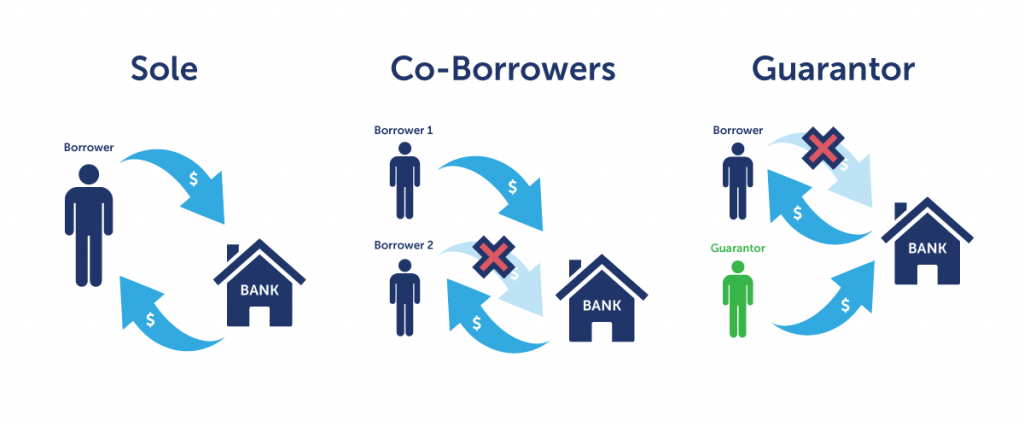

Sometimes, the terms co-borrower and co-signer are used interchangeably. But there is an important distinction between the two:

-

Co-borrower: Appears on both the mortgage and title. They are an owner of the property with equal rights.

-

Co-signer: Only appears on the mortgage. They have no ownership rights but are still obligated to repay the debt.

If someone is listed as a co-borrower, they are a co-owner. As a co-signer, they simply agree to be responsible for the loan repayment but have no claim to the home.

Who Can Be a Co-Borrower?

In most cases, a co-borrower can be any legal adult who is willing to apply with you. This person is often a spouse, family member or close friend. However, some mortgage programs do limit co-borrower options:

-

Conventional loans – The most flexible option. A co-borrower can be anyone as long as they meet eligibility criteria.

-

FHA loans – Co-borrower must be a family member or long-time friend with proof of relationship.

-

VA loans – Only a veteran’s spouse or another eligible veteran can co-borrow.

-

USDA loans – Co-borrower must live in the home as an owner-occupant.

Talk to potential co-borrowers upfront to ensure they meet program guidelines.

The Co-Borrower Mortgage Process

If you decide to move forward with a co-borrower, the application and approval process is fairly straightforward:

-

Inform your lender you want to add a co-borrower and provide their contact information.

-

The lender will have you both complete a mortgage application and provide financial documentation.

-

Your incomes, assets, debts, and credit reports will be evaluated together to determine eligibility.

-

If approved, you’ll receive a joint mortgage in both your names.

-

At closing, the deed to the home will also list both of you as co-owners.

Just like applying solo, it’s important for co-borrowers to be transparent about their finances. Hiding debts or assets could lead to issues later.

Pros and Cons of Co-Borrowing

Adding a co-borrower isn’t right for everyone. Consider these key pros and cons:

Pros

- Improved chances of approval

- Ability to buy more home

- Potentially better loan terms

- Shared financial responsibility

Cons

- Both parties are liable for total mortgage debt

- Missed payments damage both credit scores

- Legal and relationship complications if one wants to sell

- Reduced flexibility if co-borrower moves out

Think carefully about whether the benefits outweigh the risks based on your situation. And make sure to seriously vet your co-borrower.

Alternatives to Explore

If you aren’t fully comfortable with co-borrowing, look into these options instead:

-

Look for first-time homebuyer programs – Special loans for first-timers often have more relaxed requirements.

-

Improve your credit – Pay down debts and dispute any errors to boost your credit score.

-

Save up a larger down payment – Putting more money down can offset credit or income challenges.

-

Reduce monthly debts – Pay off loans and consolidate bills to improve your debt-to-income ratio.

-

Get a cosigner instead – They have no ownership rights but can still help you qualify.

-

Rent for now – Give yourself more time to improve your financial profile.

With a little perseverance, you may be able to qualify for a mortgage solo.

Is a Co-Borrower Right for You?

Co-borrowing can be a great option if you want to buy now but need help qualifying. Just be sure to fully vet your co-borrower’s finances and seriously consider the legal commitment. Weigh the pros and cons carefully before moving forward.

If you have more questions, the best thing to do is talk to a mortgage expert. They can assess your situation and help determine if a co-borrower makes sense or if alternatives may work better. With the right strategy, your path to homeownership can open up.

What is the difference between a co-borrower and cosigner?

A co-borrower’s name is seen on both the title and the loan, meaning they have a right to the property and share the responsibility of loan payback with the primary borrower on the mortgage. A cosigner does not have their name on the title or any right to the property, but is financially liable if the primary signer defaults, or is unable to pay the loan.

Take the first step and get preapproved.

Choose the checking account that works best for you. See our Chase Total Checking® offer for new customers. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 15,000 ATMs and more than 4,700 branches.

Co-Signer vs Co-Borrower | What’s the difference?

FAQ

Does a co-borrower have rights to the house?

Does it matter who is borrower and co-borrower?

What is the difference between a co-borrower and cosigner?

What are the benefits of having a co-borrower on a mortgage?

What does a co-borrower’s name mean on a mortgage?

A co-borrower’s name is seen on both the title and the loan, meaning they have a right to the property and share the responsibility of loan payback with the primary borrower on the mortgage.

What is a mortgage co-borrower?

A mortgage co-borrower is someone who applies for a home loan with another person to help them qualify for the loan or better loan terms, like a larger loan amount or lower interest rate. Co-borrowers must be included on the mortgage, and anyone included on the mortgage is automatically listed on the property’s title.

Why do I need a co-borrower on my mortgage?

Here’s an explanation for A co-borrower can enhance your chances for mortgage approval. Having a co-borrower on your mortgage may allow you to purchase a larger and more expensive home. If you purchase a house with a co-borrower, you will share ownership of the property.

Are co-borrowers the same as co-signers?

A co-borrower isn’t the same as a co-signer. With a co-borrower, both you and the co-borrower can have ownership of the property — in other words, both of your names are on the title — and are responsible for repaying the mortgage. A co-signer doesn’t have their name on the property title but is responsible for repaying the loan.