If you’re in the market for a business loan, you’ll likely come across the term “simple interest amortized loan.” While it may sound complex, it’s simply referring to a loan with straightforward simple interest that is paid back over a set repayment schedule.

In this article, we’ll break down exactly what simple interest amortized loans are, how they work, and when they may be a good option for financing your business.

What is Simple Interest?

Let’s start with a quick refresher on simple interest loans With simple interest loans, the interest rate charged remains fixed over the full term of the loan This means the percentage of interest you pay on the principal never changes.

Simple interest is calculated only on the original principal amount. It does not compound over time like other types of interest.

The simple interest rate is often expressed as a factor rate, which is the interest rate written as a decimal instead of a percentage. For example, if the interest rate is 10%, the factor rate would be 010

To find the simple interest on a loan, you multiply the principal by the factor rate by the number of payment periods.

For instance, on a 1-year $10,000 loan with a 10% simple interest rate (0.10 factor rate), the interest would be:

- Principal: $10,000

- Factor Rate: 0.10

- Term: 1 year

- Simple Interest = $10,000 x 0.10 x 1 = $1,000

So the total owed after 1 year would be $11,000 ($10,000 principal + $1,000 interest).

What is Amortization?

Now let’s look at what amortization means.

Amortization refers to gradually paying off a loan over time through scheduled installments. These installments are structured to pay down both the principal and interest over a set period until the loan is fully paid off.

An amortization schedule outlines the breakdown of how each payment is applied to interest and principal. This helps you clearly see how the loan balance declines with each payment.

Unlike simple interest calculations, amortized loans feature interest that compounds based on the payment frequency. So if it’s a monthly amortized loan, the interest compounds monthly.

The amount of interest paid decreases over time as more of the payment goes toward paying down principal. But the total periodic payment usually remains the same.

How Simple Interest Amortized Loans Work

When you combine these two concepts, a simple interest amortized loan refers to borrowing money at a fixed simple interest rate that is repaid through scheduled installments over a set loan term.

Here is an example to show how this would work:

- Loan Amount: $20,000

- Interest Rate: 10% (0.10 factor rate)

- Loan Term: 2 years with monthly payments

- Number of Payments: 24

The simple interest on this loan would be calculated as:

- Principal: $20,000

- Factor Rate: 0.10

- Term: 2 years

Simple Interest = $20,000 x 0.10 x 2 = $4,000

So the total repayable is $24,000 ($20,000 principal + $4,000 interest).

Since it is an amortized loan, this $24,000 total will be paid back over 24 monthly payments.

By plugging the numbers into an amortization calculator, you can see that each payment would be $1,010.90.

Of that monthly payment, the interest and principal breakdown would be:

- Month 1

- Interest: $166.67

- Principal: $844.23

- Month 24

- Interest: $41.58

- Principal: $969.32

The interest payment decreases over time while the principal payment increases. But the total monthly payment stays the same.

When Are Simple Interest Amortized Loans Useful?

There are a few situations where a simple interest amortized loan may be a good fit:

-

Short-term financing – The fixed interest rate and amortized payments of these loans make them ideal for short-term financing needs. They provide predictable payments that won’t fluctuate.

-

Stable cash flow – If you have a predictable cash flow, the consistent installments of an amortized loan can align well with your revenue streams.

-

Lower total interest – Compared to other amortized loans, the simple interest structure means you avoid compounding interest, which keeps overall interest costs lower.

-

Easy to understand – The straightforward interest and payment schedule can be easier to wrap your head around than complex loans with variable rates and payment options.

Pros and Cons of Simple Interest Amortized Loans

Let’s quickly summarize some key advantages and disadvantages of simple interest amortized loans:

Pros

- Fixed simple interest rate

- Gradual paydown of principal

- Predictable payments

- Lower overall interest costs

- Easy to understand terms

Cons

- Less flexible than adjustable rate loans

- Limited payment options compared to other amortized loans

- Prepayment penalties may apply

- Overall higher cost than simple interest loans without amortization

Alternatives to Consider

While they can be useful in many cases, simple interest amortized loans aren’t your only option. Here are a few other loan types to consider:

-

Simple interest loans – Short-term financing option without structured payments. You pay a lump sum at end of term.

-

Adjustable rate amortized loans – Payments still amortize principal and interest but the interest rate fluctuates with market rates.

-

Balloon payment loans – Amortized payments but a large portion of principal comes due as a lump “balloon” payment at end.

-

Interest-only loans – Pay interest charges monthly but principal is due in lump sum at end.

Be sure to talk to your lender about your repayment preferences to pick the structure that best aligns with your business needs.

The Bottom Line

Simple interest amortized loans provide fixed interest rates along with structured repayment of principal through consistent installments. This can make it easy to predict costs and align with your revenue streams. Just be sure to weigh the pros and cons compared to other loan options before moving forward.

What are the pros & cons of Simple Interest?

Here’s a quick summary of the benefits and drawbacks of simple interest loans.

Pros:

- Easier to qualify.

- Doesn’t require collateral in most cases.

- Fast funding times.

- Less total interest paid over the life of the loan.

Cons:

- Typically for lower borrowing amounts.

- Higher effective APRs.

- Higher payments could strain your cash flow.

- No way to save interest with prepayment – might have a prepayment fee.

Here are the most common questions about simple interest vs. amortization.

What are the pros & cons of Amortization?

Here’s a quick summary of the benefits and drawbacks of amortized loans:

Pros:

- Lower effective APRs in most cases.

- Typically for higher borrowing amounts.

- Longer terms & lower payments.

- Can save interest costs by paying the loan early.

Cons:

- More total interest is paid over the lifetime of the loan.

- More difficult to qualify.

- Usually requires collateral.

- Difficult to calculate.

- Longer underwriting & funding times.

What’s the Difference Between an Amortized Interest Rate and a Simple Interest Rate?

FAQ

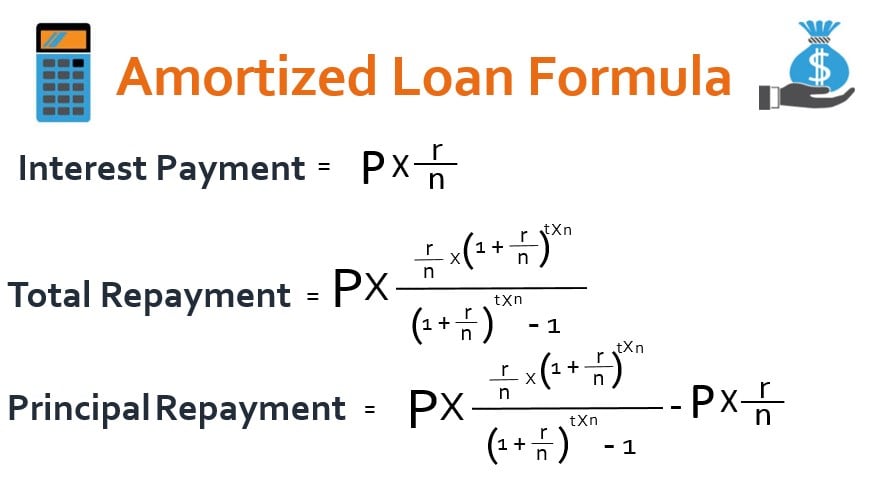

How do you calculate simple interest amortization?

How to calculate interest on an amortized loan?

Is simple interest better than amortization?

What is the difference between a simple interest loan and a mortgage loan?

What is the amortization of a simple interest loan?

The amortization of a simple interest loan is what makes the monthly payment and total interest nearly the same as a traditional loan when monthly payments are applied on the same dates.

What is an amortized loan?

An amortized loan is a type of loan with scheduled, periodic payments. The payments are applied to both the loan’s principal amount and the interest accrued. An amortized loan payment first pays off the relevant interest expense for the period, after which the remainder of the payment is put toward reducing the principal amount.

What is a simple interest loan?

With a simple interest loan, you’ll pay the same amount toward both principal and interest with each payment. Amortizing loans also tend to have compounding interest, whereas simple interest loans have (you guessed it) simple interest. If your loan has a simple interest rate, the interest is calculated only on the principal amount.

Are amortizing loans a good idea?

Some amortizing loans will allow early repayment, thereby erasing any additional interest you’d otherwise have to pay. With a simple interest loan, you’re more likely to incur a prepayment penalty, as you’re paying the same amount to interest on every scheduled payment and the lender is counting on that money.