Buying a piece of land to build your dream home on or start a new business can be an exciting prospect. However, land purchases require financing just like buying an existing home does. Land loans allow buyers to finance raw land, commercial property, or vacant lots they plan to build on in the future. But where exactly can you get a land loan?

As an aspiring land owner, it’s important to understand what a land loan is, your loan options, land loan requirements, and where to find lenders that offer these niche loan products. This guide will provide all the key information you need to know to successfully finance a land purchase.

What is a Land Loan?

A land loan, also called a lot loan, is financing specifically for purchasing vacant land parcels. Land loans are offered by banks, credit unions, farm credit organizations, and some government agencies.

Land loans differ from construction loans, which finance building a home on a property you already own. With a land loan, you are simply purchasing the land itself to hold for the future or make basic improvements on.

Land loans typically have shorter repayment terms of 1-5 years and require higher down payments than conventional mortgages, They also feature higher interest rates because they are considered riskier forms of lending,

Types of Land You Can Finance

There are a few categories of vacant land that may require specialized land loan programs:

- Raw land – Undeveloped land with no access to utilities or roads

- Unimproved land – May have limited infrastructure but still lacks utilities

- Improved land – Has road access and utilities available

The more improvements on the land the easier it will be to finance it with a conventional land loan product. Raw land often requires special financing.

You can also use land loans to finance:

- Residential lots to build a primary home on

- Land for a secondary home or vacation property

- Commercial land to start a business on

- Rural land for agricultural use

- Forested land for hunting/recreation

So land loans give you wide flexibility to purchase land for varied uses.

Land Loan Requirements

Compared to buying an existing home, land loans have stricter eligibility standards:

- Down payment – Typically 20-35% minimum

- Credit – Minimum 680-720 credit score usually required

- Income – Lenders want to see reliable income to repay the loan

- Loan-to-Value (LTV) – Loan amount vs land value is carefully evaluated

Documenting the intended use of the land and providing appraisals, surveys, and titles can also help your chances when applying.

Where To Get Land Loans

Now that you understand the basics of land loans, let’s discuss where you can actually find these niche loan products. Here are some of the most common places to get land financing:

Local Banks and Credit Unions

- Small community banks and credit unions are often the best sources for land loans. They will be familiar with property values in their local area.

- For raw land loans, a lender near the land itself is key. They will understand the potential for development.

- You’ll want to discuss vacant land financing options directly with loan officers at your local bank or credit union.

Online Lenders and Mortgage Brokers

- Many national lenders and brokers offer land loan programs, often with competitive rates.

- Working with an online lender gives you access to a wider variety of loan products.

- Land loans from online lenders still require strict documentation and appraisals.

- Rocket Mortgage is one example of a large online lender that offers helpful information on the land loan process.

Farm Credit Lenders

- Specialty farm credit lenders like Farm Credit and Farm Service Agency provide land financing for agricultural properties.

- These lenders have experience with rural land values and development costs.

- Farm loans can be used to buy farmland or make improvements like irrigation, barns, or machinery storage.

Government Land Programs

Certain government agencies like the USDA and VA offer land financing options including:

- USDA Land Loans – For buying rural land to build or operate a farm on.

- VA Land Loans – Help veterans and service members buy land to build a home on.

Government land loans provide benefits like low rates and down payments. But you must qualify based on location, income limits, and other factors.

Private Land Sellers

- Some land owners may directly finance the sale of their land to a buyer instead of requiring traditional financing.

- This type of private land loan is also called seller financing or an owner carry loan.

- Seller financing terms are customizable between the buyer and seller.

- Buyers can potentially qualify more easily compared to taking out a bank land loan.

No matter what type of land loan source you utilize, be sure to shop around and compare options. Land financing can vary widely, so explore both local and online lenders to find the best fit.

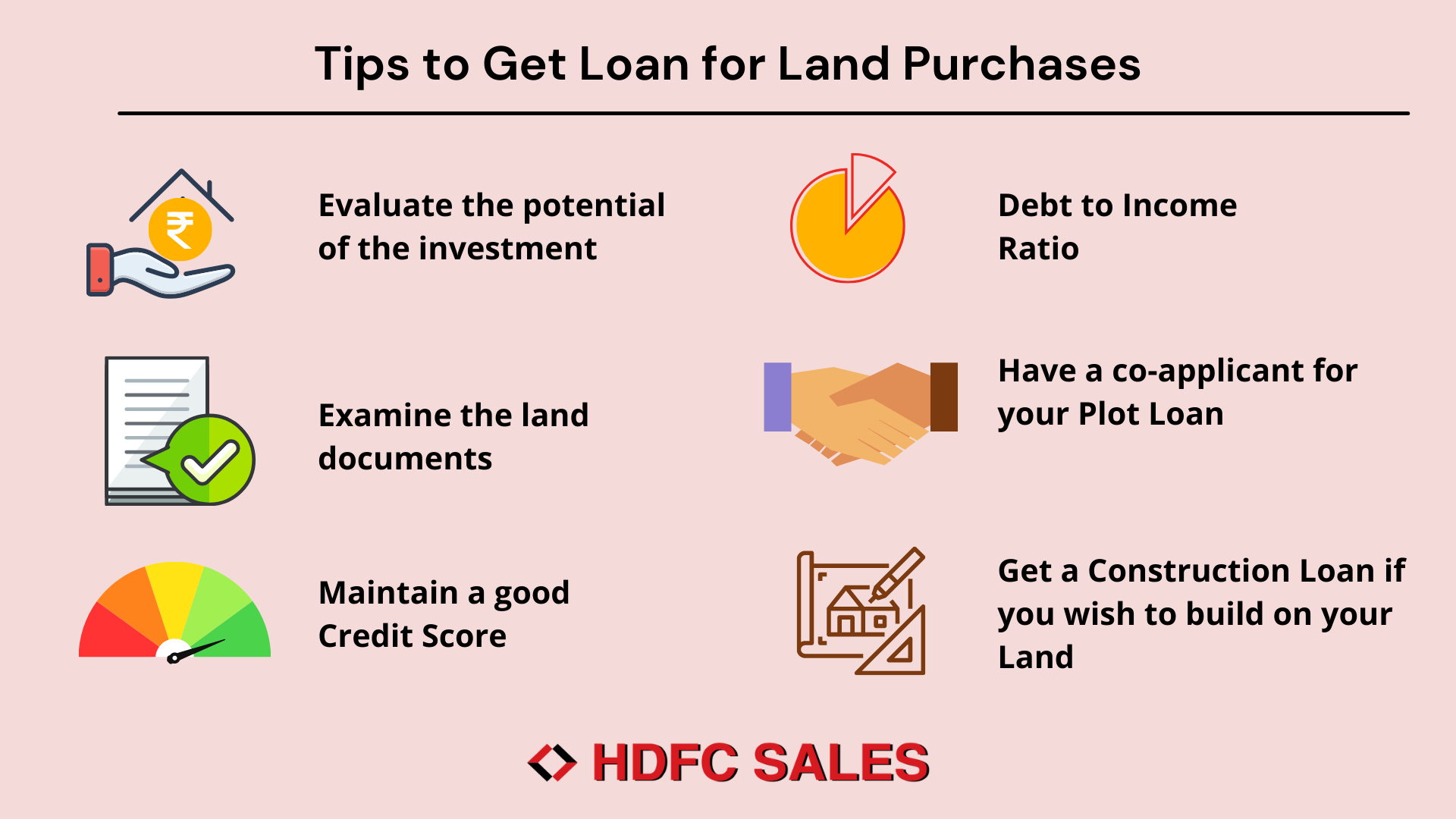

Tips for Getting Approved

Since land loans are a niche product and come with more stringent requirements, it helps to strengthen your application. Here are some tips:

- Make a large down payment – Putting 20-25% down or more can really help your chances

- Highlight your plans – Show lenders your detailed plans for using the land

- Have excellent credit – Aim for a score of 720 or higher

- Lower your debt – Reduce other loans and credit balances beforehand

Also be prepared to provide extensive documentation such as:

- Land appraisal

- Certified survey

- Title search

- Information on zoning, taxes, mineral rights, easements, etc.

Taking these steps shows lenders you are a serious buyer with the means to purchase and develop vacant land.

Pros and Cons of Land Loans

Before applying for a land loan, weigh some of the key pros and cons:

Pros

- Finance land purchases on flexible terms

- Buy land now to hold or develop later

- Build your dream home on an ideal lot

- Start a business on new commercial property

Cons

- Higher rates and fees than other loans

- Need excellent credit to qualify

- Short 1-5 year repayment terms

- Lenders perceive it as a risky product

As you can see, land loans offer great opportunity to invest in vacant land but do come with some drawbacks. Understanding both sides will help set proper expectations.

Alternatives to Land Loans

If you have trouble qualifying for a land loan, there are a few alternative financing options including:

- Construction loans – Build a house immediately on land you already own

- Home equity loan – Use equity from an existing home as financing

- 401(k) or IRA funds – Finance a land purchase using retirement account funds

- Hard money loans – Asset-based financing from private investors

However, these may come with their own restrictions or drawbacks to consider as well.

The Bottom Line

Finding available land financing will take some savvy research into specialized lenders offering land loans. Local banks and credit unions, farm lenders, government loan programs, and private land sellers represent your best options to explore.

With proper preparation, excellent credit, and realistic plans for the land, you can be on your way to buying your ideal parcel and making great use of it. Land loans unlock the opportunity to purchase open land parcels for both personal and business purposes.

Frequently Asked Questions

What credit score is needed for a land loan?

Most lenders want to see a minimum credit score of around 700 or higher to qualify for a land loan. A strong score shows the lender you are a low risk for this type of financing.

How much does a land loan cost?

Land loans will have interest rates ranging from 5% to 10% depending on your credit, loan terms, and other factors. Fees may include 1% to 3% in origination charges. Total borrowing costs are higher than conventional mortgages.

Should I get pre-approved for a land loan?

Yes, going through pre-approval before you bid on or buy land is highly recommended. Pre-approval provides proof you can finance the purchase, making your offer stronger.

How long does it take to get a land loan?

The land loan process typically takes 1 to 3 months from application to funding. Timing varies based on the lender and complexity of your specific loan. Expect a smoother process if you have excellent credit and strong documentation.

What is the maximum loan term on a land loan?

Land loan terms are much shorter than traditional mortgages, usually ranging from 1 year to 5 years maximum. Longer terms may be available in some cases. You’ll have to refinance to a conventional mortgage once you build on the land.

Key Takeaways:

- Land loans help buyers finance vacant land they want to purchase and hold for the future.

- Local lenders, farm credit organizations, government programs, and private sellers all offer land financing.

- Requirements like 20%+ down payment and 700+ credit score are typical.

- Land loans have higher rates and shorter repayment terms than

Our process puts you in control.

Convenient online access makes it easy to achieve your financial and homeownership goals.

Estimate your monthly payment

See how much home you can afford

Estimate your amortization schedule

Start your home loan journey today.

There are a lot of great mortgage options out there, but you might not see them if you work with a big bank. As Canada’s premier mortgage broker, we help you find the best mortgage option for you.