Assuming a loan agreement can be a great way to purchase a home without taking out a new mortgage But it does come with some risks and requirements, Here’s what you need to know about assuming someone else’s mortgage loan

What is a Loan Assumption?

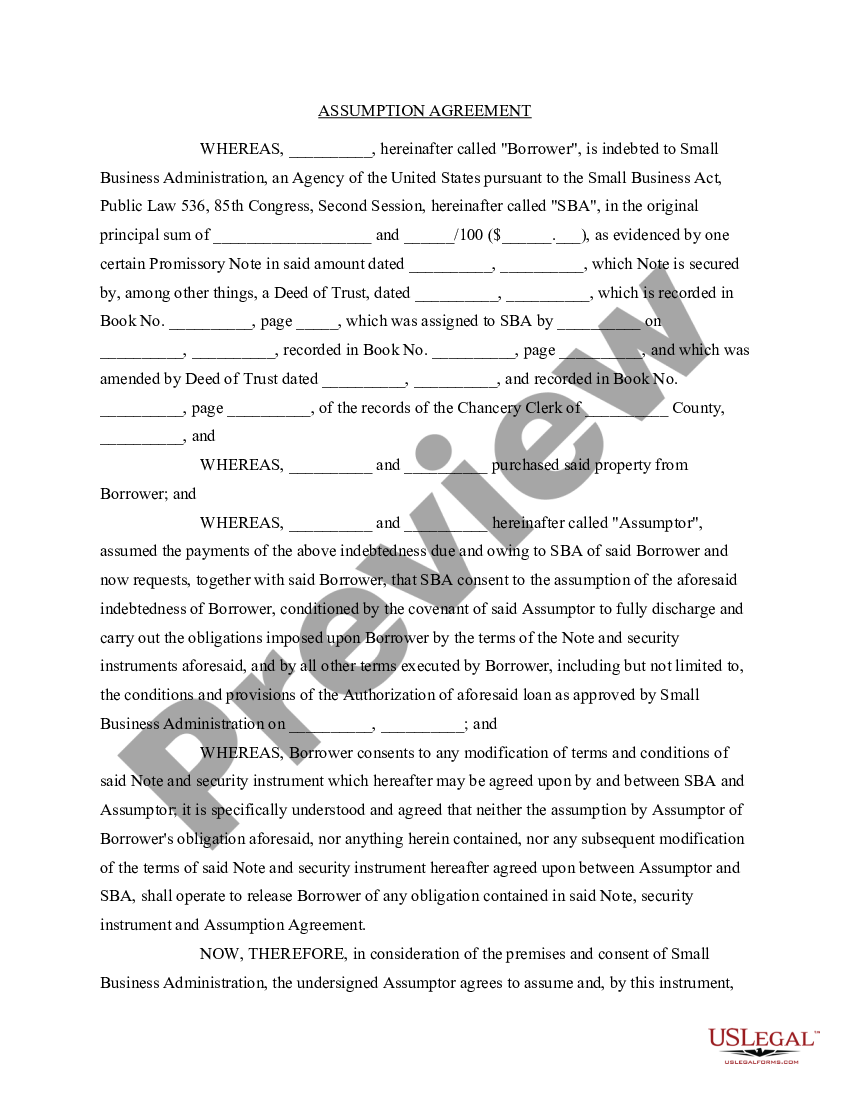

An assumption of loan agreement is when a new buyer takes over the seller’s existing mortgage loan This transfers the loan obligation from the original borrower to the new homebuyer

The new borrower assumes responsibility for making the remaining monthly payments and paying the loan balance in full They also take on all other terms of the original loan agreement

How Does a Mortgage Assumption Work?

Here are the typical steps for assuming a mortgage loan:

-

Seller finds a qualified buyer who agrees to assume their mortgage.

-

Buyer applies to the lender and provides required financial documentation.

-

Lender reviews the buyer’s application and approves them for the assumption.

-

Buyer and seller sign an assumption agreement transferring liability to the buyer.

-

Lender releases original borrower from liability and updates their records.

Now the new owner makes the ongoing mortgage payments instead of the seller. They become responsible for paying property taxes, homeowners insurance, and maintaining the home.

What are the Benefits of Assuming a Mortgage?

There are a few potential advantages to assuming an existing home loan:

-

Lower interest rate – If rates have gone up, assuming a lower fixed rate saves money.

-

Skip origination costs – No loan application or appraisal fees to take out a new mortgage.

-

Faster closing – Assumption may streamline the buying process without loan underwriting.

-

Increase buying power – Keeping the seller’s low balance frees up funds for a larger down payment.

-

Pay no early repayment penalties – Avoid fees for refinancing an existing mortgage.

For buyers, assumptions offer the ability to get into a home without the hassle and expense of a new loan.

What are the Risks of Assuming a Mortgage?

On the other hand, here are some of the potential downsides to be aware of:

-

Missed documents or fees – You become responsible for any issues with the original loan, even if overlooked.

-

No escrow account – You may have to take over insurance and tax payments if no escrow was set up.

-

Ineligible for programs – May not qualify for mortgage assistance programs with an assumed loan.

-

Difficult to refinance – Lenders cautious about refinancing assumed loans without seasoning period.

-

Balloon payment due – Responsible for large payment if loan has a remaining balloon payment.

Make sure to go over the loan details carefully before taking over someone else’s mortgage obligation.

Loan Assumption Eligibility and Requirements

Most conventional loans can be assumed, though lenders have specific eligibility standards:

-

Credit score/debt levels – Must meet guidelines for new loans to qualify.

-

Down payment – Typically at least 5% down required if no equity already.

-

Occupancy – For primary residence loans. Not eligible on investment properties.

-

Loan type – Conventional loans can be assumed. Other loans have restrictions.

-

Previous 12 months payments – Original borrower must have acceptable 12 month pay history.

In addition, lenders require the following for approval:

-

Credit/Income verification – Standard documentation needed to underwrite assumption.

-

Property inspection – Appraisal or interior valuation required in most cases.

-

Gift funds paperwork – Properly documented if receiving any gift money for down payment.

-

Assumption fee – Charged by lender to process the application, around $300 to $900.

-

Assumption agreement – Signed by buyer, seller, and lender approving transfer.

It’s critical to work with a loan officer experienced in assumptions to steer you through the process.

Steps for Assuming a VA or FHA Loan

VA and FHA loans have special assumption guidelines:

VA loans – No lender review or credit check needed if buyer assumes VA loan. But need VA eligibility and enter new loan with lender.

FHA loans – FHA allows assumptions but reviews credit, income, and requires an upfront mortgage insurance premium.

For government-backed loans, the assumption keeps the original loan guarantees intact. But follow the procedures to avoid jeopardizing the loan status.

Tips for a Smooth Mortgage Assumption Process

To make the loan assumption process easy on both sides:

-

Review loan documents early – Check for red flags like prepayment penalties or balloon payments.

-

Consult professionals – Real estate attorney and tax advisor to avoid overlooked liabilities.

-

Don’t skip inspections – Thoroughly inspect home for defects that could become your problem.

-

Negotiate home warranty – Ask seller to provide a protection policy for defects found later.

-

Verify payments ahead – Avoid surprises by confirming mortgage payments are current before assuming.

-

Plan for ownership costs – Budget for maintenance, repairs, utilities if not escrowed.

With the right preparation, a mortgage assumption can be a win-win for both buyer and seller!

Alternatives to Assumed Mortgages

If assuming an existing mortgage doesn’t work out, here are a couple options that provide some similarities:

-

New loan with lower rate – If buyer has excellent credit, they may qualify for today’s near historic low rates.

-

Seller financing – Seller carries a private second mortgage for a portion of the purchase price.

Look at all the angles before deciding that stepping into someone else’s shoes on their mortgage is the optimal route for you.

The Bottom Line on Assuming Loans

Taking over payments on the seller’s mortgage can allow you to buy a home with little cash out of pocket. But proceed with caution – make sure you can handle the financial obligation before signing on the dotted line.

With proper diligence upfront, a loan assumption can be a wise move. But the wrong situation can saddle you with an expensive burden. Consider both the pros and cons carefully when weighing this decision for your home purchase.

Loan Assumption – What You Need To Know Before Assuming a Loan

FAQ

What is required for a loan assumption?

Is loan assumption a good idea?

Who is liable in a loan assumption?

What is a debt assumption agreement?