Having multiple home equity loans is an uncommon scenario, but it is possible under the right circumstances As a homeowner, you may be wondering if you can qualify for and manage more than one home equity loan This article will provide a comprehensive overview of the ins and outs of having two home equity loans.

What Is A Home Equity Loan?

Before diving into the specifics of having two home equity loans, let’s review what exactly a home equity loan is. A home equity loan is a type of second mortgage that allows you to borrow against the equity in your home.

Equity is the difference between what your home is worth and what you owe on your primary mortgage For example, if your home is valued at $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity

With a home equity loan, you can tap into a portion of that equity – up to 85% – and receive the amount in a lump sum. You’ll pay back the loan over a fixed repayment term with a fixed interest rate.

Home equity loans are useful for major expenses like home renovations college tuition, medical bills or consolidating high-interest debt.

Is It Possible To Have Two Home Equity Loans?

The short answer is yes, you can have two home equity loans on the same property. There is no legal limit to the number of home equity loans you can obtain.

However, just because you can have two home equity loans does not necessarily mean you should. There are a number of factors to consider before taking out multiple home equity loans.

Lender Rules On Multiple Home Equity Loans

While there are no legal limits, individual lenders often place restrictions on the number of home equity loans they will approve for one property.

Many lenders, including major banks and lenders like Rocket Mortgage, do not allow more than one home equity loan on the same home. Their rationale is that each additional loan is riskier than the previous one.

Still, some smaller lenders may permit two home equity loans on a case by case basis if you meet their qualification criteria.

Qualifying For Two Home Equity Loans

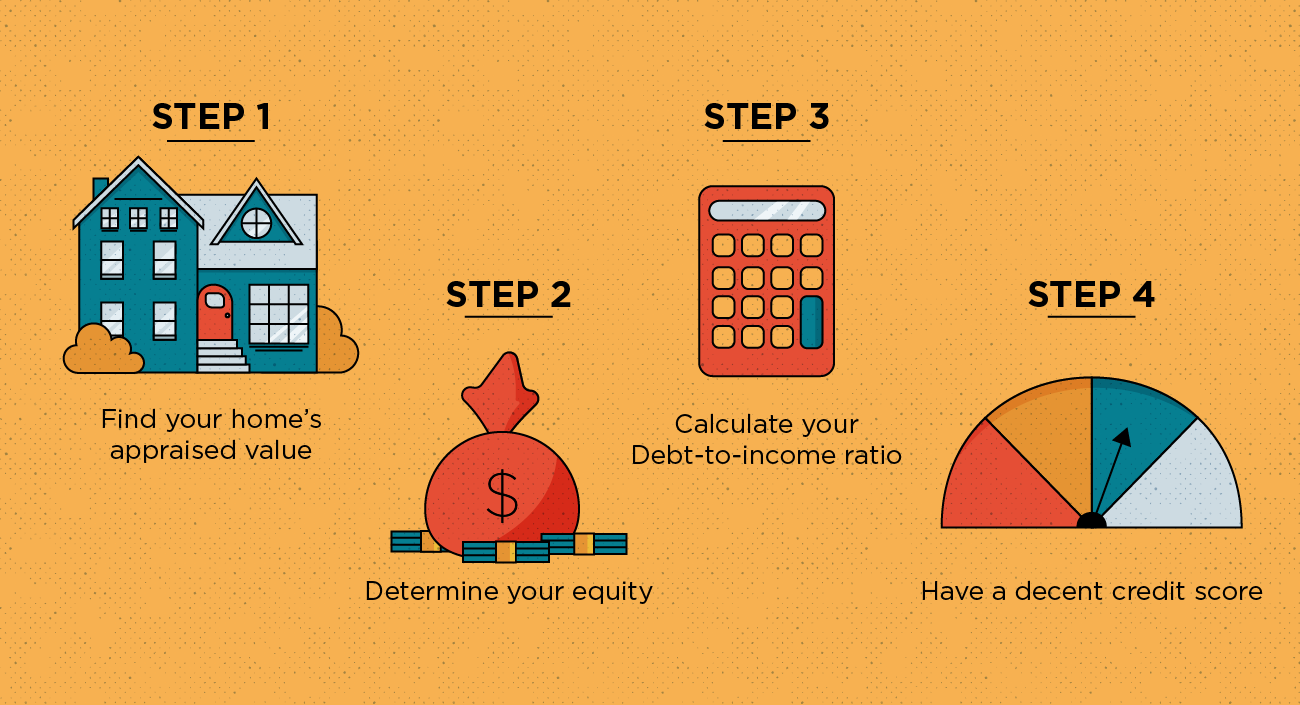

Obtaining approval for two home equity loans requires meeting strict eligibility standards. Here are some of the key requirements:

-

Credit score: Due to the higher risk, home equity loan credit score requirements are higher than purchase mortgages. Expect to need at least a 680 credit score for the first loan, and 720+ for the second.

-

Debt-to-income ratio: Lenders want to see you can afford both loan payments. Your total monthly debts divided by gross monthly income should be 50% or less.

-

Loan-to-value ratio: Most lenders require a maximum of 80-85% combined loan-to-value ratio. That means after taking out both loans, you must have at least 15% equity remaining in the home.

-

Sufficient income/assets: You’ll need to demonstrate the means to repay both loans. Expect to provide extensive income and asset documentation.

Meeting the above stringent criteria is difficult, which is why most borrowers do not end up with two home equity loans on one property.

Pros And Cons Of Two Home Equity Loans

Let’s examine the potential benefits and drawbacks of having two home equity loans:

Pros

- Access to larger lump sums for major financial goals

- Can complete more expensive home improvements

- Potentially lower interest rate to consolidate higher-rate debts

Cons

- Higher monthly payments

- Increased risk of default if home value declines

- Potentially more complicated to sell home or refinance later

- Higher origination fees and closing costs

- Difficult to qualify for two loans

As you can see, while a second home equity loan provides more capital upfront, it also comes with heightened financial risk and more complex mortgage terms.

Alternatives To A Second Home Equity Loan

Instead of taking out a second home equity loan, you may want to consider these options to access funds:

-

Cash-out refinance: Consolidate both loans into one new mortgage.

-

HELOC: Gain flexibility with a home equity line of credit.

-

Personal loan: Unsecured loan without putting your home at risk.

-

Using home equity: Sell your home and downsize or rent to unlock equity.

-

Credit cards: 0% intro APR cards can provide short-term financing.

Each alternative has its own pros and cons to weigh before deciding.

Tips For Managing Two Home Equity Loans

If you determine a second home equity loan makes sense for your situation, here are some tips to manage the two loans properly:

-

Shop around for the lowest rates and best terms.

-

Understand the risks and have a repayment plan.

-

Make payments on time to protect your credit score.

-

Be conservative when estimating future home value appreciation.

-

Maintain a rainy day emergency fund in case of financial hardship.

-

Refinance into a single loan once equity built back up.

-

Consult a financial advisor to ensure it aligns with your goals.

The Bottom Line

While legal, taking out two home equity loans on your property is an uncommon scenario. You must have prime credit, significant equity, and the capacity to handle two loan payments to qualify. Weigh the risks and rewards carefully, as a second loan can jeopardize your finances and homeownership if managed improperly.

Thoroughly research your options before moving forward. But if structured prudently, two home equity loans can provide access to funds that help you achieve your financial objectives.

Unlocking Your Home’s Equity: A Guide to Multiple HELOCs

Your home is more than just a place to live—it’s a valuable asset that can provide financial flexibility when you need it most. With the rising costs of living and unexpected expenses, homeowners are increasingly looking to tap into their home’s equity. One popular method is through a Home Equity Line of Credit, or HELOC. But what if one HELOC isn’t enough to meet your financial goals? Can you have more than one HELOC on the same property? This comprehensive guide delves into the intricacies of securing multiple HELOCs, from understanding the qualifications and the application process to managing the financial implications and exploring alternative financing options. Whether you’re looking to finance home improvements, consolidate debt, or invest in real estate, we’ll provide you with the expert advice and insights you need to navigate this complex financial landscape with confidence.

Navigating Risks with Multiple HELOCs

With each additional HELOC, you’re increasing your financial commitments, which heightens the risk of foreclosure should you struggle to meet repayment terms. As your home is the collateral for the loan, defaulting on a HELOC can have serious consequences, including the loss of your property.

HELOCs often come with variable interest rates, meaning your payments can change based on market conditions. An increase in rates can lead to higher monthly payments, which may be challenging to manage with multiple HELOCs. It’s important to ensure that the total payments are within your budget, as emphasized by Banks.com.

In conclusion, while securing multiple HELOCs can provide financial leverage, it’s imperative to consider how they may affect your credit score, DTI ratio, and credit utilization. Understanding these factors will help you make decisions that align with your financial goals and maintain a healthy financial standing. If you’re considering this financial move, we’re here to offer guidance and support to ensure you navigate this process with confidence. For more detailed information on HELOCs, you can refer to our article on what is a HELOC loan and how does it work.

HELOC Vs Home Equity Loan: Which is Better?

FAQ

Can I have two home equity loans at the same time?

How many home equity loans can I have?

What is a second home equity loan?

Can I get a home equity loan if I already have a mortgage?

Can I take out multiple home equity loans?

You may take out multiple home equity loans with the same lender or different lenders. If you use the same lender, however, you might find the process to be faster and more straightforward. Your chances of approval might be higher as well.

Can I have more than one home equity loan?

This means you can’t have more than one home equity loan. You also can’t take out a home equity loan at the same time you take out a primary mortgage. Beyond that, lenders will require that you have sufficient funds to make your payments and a low debt-to-income ratio (DTI). We require a DTI no higher than 50%.

Can you get a second home equity loan with the same lender?

There’s no regulation that says you have to work with the same lender to get a second home equity loan. However, on the off chance that a lender approves you for a second home equity loan, they might be more likely to approve you if they hold the first one than if you went with a totally different lender.

How many financed homes can you get a home equity loan?

While there’s no limit to the number of existing mortgages you can have if you’re getting a home equity loan for a primary property, the maximum is 10 financed homes if you’re getting a loan for a second home. If you have more than six financed properties, the qualifying credit score must be 720 or higher.