Taking out a home equity loan can provide funds for major expenses like home improvements, debt consolidation, and more. But these loans come at a cost in the form of interest charges over the repayment term. The faster you can pay off your home equity loan, the more money you’ll save on interest

In this comprehensive guide, we’ll explore smart strategies to help you pay off your home equity loan ahead of schedule Read on to learn how making extra payments, refinancing, and more can accelerate your path to becoming debt-free.

Overview of Home Equity Loans

Before diving into payoff tactics, let’s briefly recap how home equity loans work. A home equity loan is a type of second mortgage that lets you borrow against the equity in your home.

Equity represents your ownership stake in the home – specifically, the appraised home value minus what you still owe on your first mortgage. As you pay down your mortgage, you build equity over time.

Lenders will let you borrow up to a certain percentage of your equity, often around 80%, at a fixed interest rate. The loan is repaid in set monthly installments over a repayment term, usually 10-30 years.

Home equity loans differ from home equity lines of credit (HELOCs) in that you receive the full loan amount upfront rather than having a revolving credit line.

Benefits of Paying Off Early

Though home equity loan terms can span decades, you’re not necessarily stuck making payments for the full length. Paying off your loan faster can provide multiple advantages:

-

Save on interest – Less interest accrues when you owe for less time. This can mean thousands in interest savings.

-

Own your home outright – Eliminating your home equity loan and mortgage builds significant equity.

-

Reduce debt – Paying off a loan quickly frees up cash flow.

-

Improve credit – Demonstrating responsibility can boost your credit score.

Depending on your financial goals, the savings and other benefits associated with early repayment may motivate you to pay more than the minimums.

Ways to Pay Off Your Loan Faster

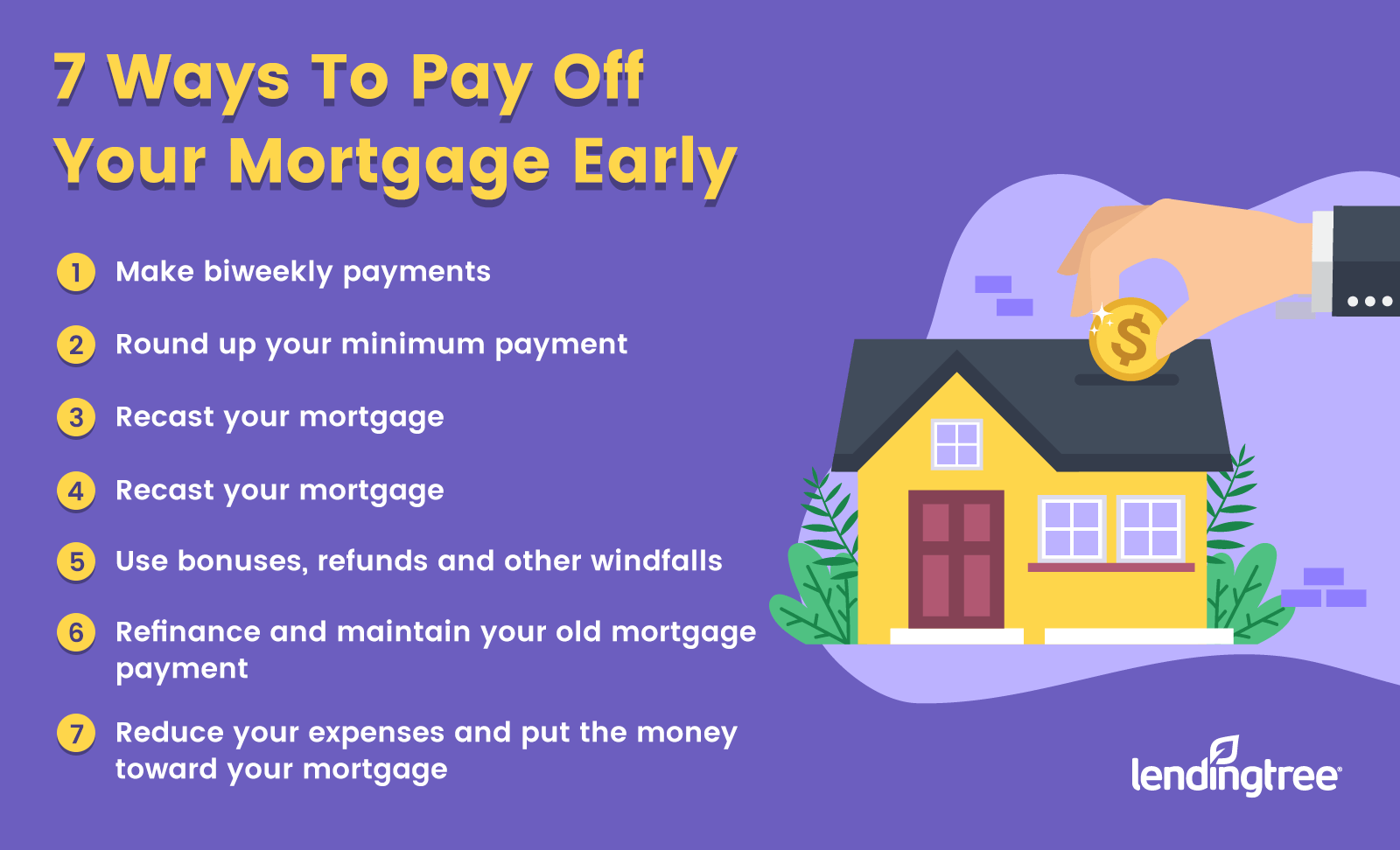

If you want to pay off your loan ahead of schedule, here are some proven strategies to get there quicker:

Make extra payments – Send any additional cash on hand toward the principal to pay it down faster. Even small extras help.

Pay biweekly – Making half-payments every two weeks saves interest and shaves years off the term.

Pay lump sums – Use windfalls like bonuses or tax refunds to make one-time big payments.

Refinance – You may qualify for a lower rate through refinancing, reducing interest costs.

Reset the term – Refinancing into a shorter term increases monthly payments but pays the loan off sooner.

Make one extra payment per year – Adding a single extra payment annually can knock off years.

Prioritize payments – Temporarily pause retirement or other savings contributions and use that cash to pay down your loan instead.

Sell assets – Consider selling valuable items and using the proceeds to cover a chunk of your outstanding loan balance.

The more additional cash you can apply to the principal through these strategies, the faster you’ll become debt-free. Every little bit counts.

Is My Loan Eligible for Early Repayment?

Before putting extra funds toward home equity loan repayment, it’s important to verify there are no prepayment penalties involved. Some loans charge fees for paying off the balance before the end of the term.

Thankfully, most home equity loans today do not have prepayment penalties. But it’s crucial to read your loan agreement thoroughly to confirm there are no charges for early repayment. You can also call your lender directly to inquire.

As long as no prepayment penalties apply, you should be in the clear to pay off your home equity loan as fast as you want without incurring fees. Doing so can save you thousands in interest payments over the life of the loan.

Making Regular Extra Payments

One simple way to chip away at your loan faster is to add a little extra to your normal monthly payments. Even small amounts can make a surprising difference.

For example, on a $50,000 home equity loan at 5% interest over 20 years, just adding $25 per month pays off the loan 3 years sooner and saves over $5,000 in interest.

Of course, the more you can afford to add, the greater the impact. If your budget comfortably allows $200 extra per month, you’d pay that same loan off in under 13 years with $12,000+ in interest savings.

Set up automatic transfers to have additional funds go straight to your lender along with your normal monthly payment. Little bites will eventually get your balance paid off well ahead of schedule.

Refinancing Your Home Equity Loan

Another option to accelerate repayment is refinancing your existing home equity loan into a new one. There are a couple potential benefits of refinancing:

Lower interest rate – If rates have dropped since you took out your original loan, refinancing can lower the interest charged, saving money.

Shorter term – You may opt to refinance into a loan with a shorter term, which increases monthly payments but pays off the balance quicker.

Run the numbers carefully when considering refinancing. Closing costs for the new loan can eat into savings, so ensure you’ll remain in the home long enough to recoup those expenses through lower interest payments over time.

Refinancing shines when you can both reduce your rate and shorten the repayment term for a double impact. Just beware of extending the term longer, which costs more in interest.

Using Lump Sum Payments

An aggressive but effective approach is making occasional lump sum payments when extra funds allow. Things like bonuses, tax refunds, inheritance money, or proceeds from selling assets present great opportunities for one-time big payments against your home equity loan balance.

Even a single lump sum payment equivalent to a year’s worth of payments would knock significant time off your loan term. Making such large extra payments whenever possible provides major progress.

Just be sure to specifically direct the lender to apply lump sums to the principal balance. You also need to request a payoff statement first so you can calculate the exact amount required to pay off the loan if that’s your goal.

Budgeting and Lifestyle Changes

To free up additional cash for accelerated repayment, take a hard look at your expenses. Can you reallocate any existing budget categories to make extra principal payments instead? Things like reducing dining out, entertainment, or discretionary purchases can help.

Temporarily pausing retirement plan contributions gives you more cash in hand to put toward loan repayment until you become debt-free. That pause should only be temporary though, as long-term retirement savings are crucial.

Overall, concentrating your cash inflow toward conquering your home equity loan will ensure you pay it off years earlier. The savings you’ll enjoy make it a worthwhile focus.

Is Using Home Equity to Pay Off a Loan Wise?

Some homeowners consider tapping available equity again via a new cash-out refinance or loan to pay off their existing home equity loan entirely. This consolidates debt into a single payment.

The risk? You undo the equity you’ve built up by borrowing against the home once more. This can leave you still in debt long-term. It may be better to make sacrifices to pay off your current loan without taking on new debt.

However, if you can get a drastically lower rate/payment through a new consolidated loan, it may enable you to pay off the balance even faster. Do the math carefully to see if it results in real savings versus added costs.

Recouping Cash From Your Home

Beyond loans, you may look at other ways to extract cash from your home value to make lump sum payments. For instance:

-

Home sale – Selling your home provides proceeds that can pay off the loan. You’d need to purchase a lower cost house though without taking on as large of a mortgage.

-

Reverse mortgage – Borrowers 62+ can access equity via a reverse mortgage. Use funds to eliminate your existing home equity loan.

-

Home equity loan buyout – Some companies may offer to buy out your loan in exchange for an upfront payment to you and taking over your payments.

These options provide alternatives to pull equity for a payoff if you don’t want to take out another traditional loan. All have their own pros and cons to weigh carefully.

Paying Pointers

Here are some final tips for smoothly paying off your home equity loan ahead of schedule:

-

Make payments on the exact due date to limit accrued interest between payments.

-

Have payments autodrafted from your checking account to avoid late fees.

-

Monitor your online account regularly to confirm payments are being applied properly.

-

Notify your lender when making large lump sum payments to ensure the funds are allocated correctly.

-

Request an updated payoff statement from your lender before making a final payment.

The Bottom Line

Paying off your home equity loan early saves significant money on interest payments. From budgeting for extra payments to refinancing to lump sums, numerous strategies exist to help accelerate repayment

Mitigating Default Risks and Understanding Lender Liens

A HELOC is secured by your home, which means the lender can claim a lien or even foreclose on your property if you default on the loan. To manage this risk, it’s crucial to plan for the transition from the draw period, where interest-only payments are common, to the repayment period, which includes principal repayment and results in higher monthly payments.

Paying off your HELOC early can lead to substantial interest savings and provide financial relief. Always confirm with your lender that additional payments are applied to the principal and that no prepayment penalties apply. While accelerating HELOC repayment has its advantages, it’s vital to proceed with a comprehensive understanding of the financial implications.

For more information on managing HELOC payments and avoiding potential risks, The Balance Money and Experian offer detailed guidance. Additionally, understanding the differences between a HELOC vs. home equity loan for renovating can further inform your financial decisions.

The Benefits of Cash-Out Refinancing

Cash-out refinancing is a popular method that involves replacing your existing mortgage with a new loan for a greater amount than what you currently owe. The difference is provided to you in cash, which can be used to pay off your HELOC. This strategy is particularly beneficial if you have built up substantial equity in your home and can obtain a more favorable interest rate. It’s important to consider the closing costs associated with refinancing to ensure that the long-term savings outweigh these immediate expenses.

For veterans, the VA-backed cash-out refinance loan offers an opportunity to access home equity with the potential for competitive rates and terms. It’s essential to understand the eligibility requirements, such as having a Certificate of Eligibility and occupying the home you wish to refinance.

How to Pay Off Your HELOC Faster

Should I pay off my home equity loan early?

If you borrowed at a low interest rate, it may be worth paying on your current payment plan and investing the money you would have used to pay off the loan faster. If your goal is to eliminate monthly payments, paying the loan off early may be more attractive than what you would earn in the market. How Do I Pay Off My Home Equity Loan Early?

How long does it take to pay off a home equity loan?

Search all of Regions How long will it take to pay off a home equity loan or line of credit? The length of time it takes to pay off a home equity loan or line of credit is largely driven by the interest rate paid on the outstanding balance, how much you continue to use the line of credit and what monthly payment is made each month.

Can a home equity line of credit pay off a mortgage?

A homeowner can use a home equity line of credit to pay off an existing mortgage and potentially reduce monthly payments as well as the total interest cost of the loan.

Should you pay more for your home equity loan?

Many borrowers choose a longer term for their loan so that they have more breathing room in their monthly budget with a lower monthly payment. But if they find that their income increases, paying more toward the principal of their home equity loan can save significant interest payments.