You’re our first priority. We want you to understand how we make money. This post may contain affiliate links. Biglaw Investor may receive a commission at no additional cost to you if you click on the links in this article. This may influence which products we write about and where and how the products appear on a page. However, it does not influence our evaluations. Our opinions are our own. In some circumstances, if you work with us, we are able to provide an incentive to work with our advertising partners that is unavailable if you work with our advertising partners directly. Our partners cannot pay us to guarantee favorable reviews of their products or services. To read more about how we make money, click here.

JD MORTGAGE® connects you with lenders who want to help you build a new home or renovate an existing property. We find the lenders that offer terms specially tailored to your goals.

Offered exclusively through Biglaw Investor, we make it incredibly simple to find the best loan for your construction financing needs.

Georgia has been an economic powerhouse in the southern United States for many years. With a strong economic base in Atlanta, the state is home to many large corporations and small businesses.

With all this economic activity, it’s no surprise that the state is growing and housing prices are increasing. The state’s average sales price is $406,102 according to the Georgia Realtors Association. The state is doing so well that it has one of the lowest foreclosure rates in the nation as homeowners are able to consistently make their mortgage payments. In fact, homebuyers are making real estate moves in one of the fastest and most competitive markets, which is why many are looking beyond conventional loans.

For some homeowners, construction loans are becoming more and more common as they consider the benefits of building a new home or renovating an older home compared to buying in the hot real estate market. Rather than negotiating with a seller, you could be coordinating with an architect on creating blueprints for a custom home. Kick off your construction project quickly with a lender, down payment, and home construction loan. As a borrower, you’ll look for the perfect place to build and get a short term construction loan to build your dream home.

When finding the right construction lender, it’s important to work with a loan officer that has experience in construction loans. You don’t want to work with someone who mainly focuses on traditional mortgages as construction loans are a different animal entirely. We have a network of battle tested construction loan officers with experience overseeing thousands of new homes.

If you’re looking to build a new home in Georgia, one of the most important things you’ll need to research is construction loan rates. As you shop around with different lenders, you’ll find that construction loan rates can vary significantly. Taking the time to find a lender with the best rates and loan terms for your situation can end up saving you thousands of dollars over the life of your loan.

In this comprehensive guide, we’ll walk you through everything you need to know about getting a construction loan in Georgia, with a focus on finding the most competitive interest rates.

An Overview of Construction Loans in Georgia

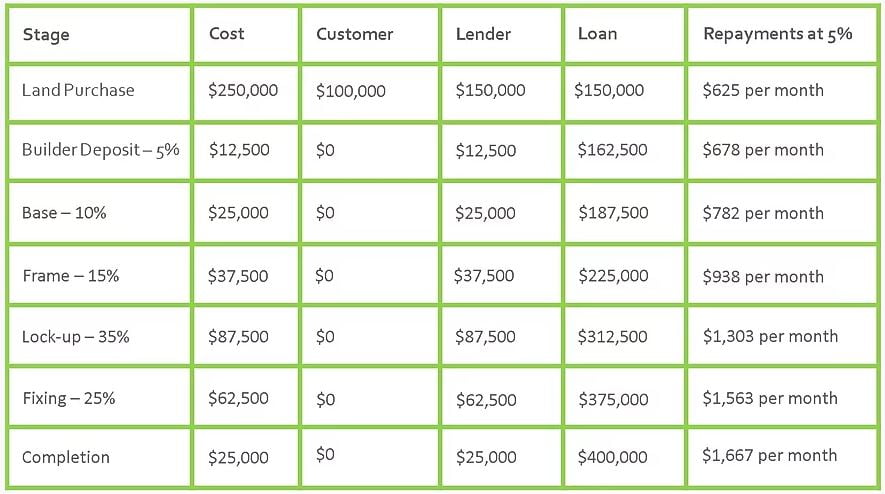

A construction loan is a short-term loan used to finance the building of a new home. These loans provide periodic payouts to the builder as construction reaches certain milestones, allowing you to only pay interest on the money that has been drawn.

Construction loans are typically adjustable rate mortgages, with rates fluctuating as you build. Once construction is complete, the loan converts to a fixed rate mortgage This structure allows you to lock in low rates even if market rates rise during the building process.

In Georgia, construction lending is robust, with many national, regional, and local banks offering construction loan programs. When shopping for rates, make sure to get quotes from multiple lenders, as rates and fees can vary significantly.

Factors That Influence Construction Loan Rates in Georgia

Construction loan rates are based on a variety of factors, including:

-

Credit score – borrowers with higher credit scores qualify for lower rates. FICO scores above 740 will get the best pricing.

-

Loan-to-value ratio – the higher the LTV, the higher the rate. Look for loan programs with LTVs at 80% or below.

-

Loan size – larger loan amounts often qualify for lower rates due to lower relative fees.

-

Property type – primary residences generally get better rates than investment properties.

-

Interest rate locks – locking in your rate once can prevent fluctuations during construction.

-

Loan fees – look for lower origination fees and closing costs to reduce your total costs.

5 Tips for Finding the Best Construction Loan Rates

Follow these tips when shopping for a construction loan to ensure you find the most competitive rates and terms:

1. Check Your Credit Score

Having a credit score above 740 will put you in the best position for low rates. If your score is below 700, take time to improve it before applying.

2. Get Quotes from Multiple Lenders

Rates vary between banks, so casting a wide net will ensure you don’t leave savings on the table. Apply with several lenders to get a range of rate quotes.

3. Ask About Interest Rate Locks

Locking your rate once construction begins will prevent fluctuations. Ask each lender about their rate lock policies.

4. Look for Loan Discounts

Many lenders offer discounts for repeat customers or other affiliations that can lower your rate. Inquire about any available discounts.

5. Negotiate Fees and Costs

Look for lenders that offer low origination fees and closings costs, and don’t be afraid to negotiate. Every dollar counts!

Comparing Construction Loan Rates from Top Georgia Lenders

To give you a sense of current market rates, here is an overview of construction loan rates from several top lenders in Georgia:

Georgia’s Own Credit Union

- Rates as low as 6.25% APR

- 80% max LTV

- $0 origination fee

- Credit score requirements start at 620

Ameris Bank

- Rates starting at 7.35% APR

- 85% max LTV

- $595 origination fee

- Credit score requirements start at 700

Century Bank of Georgia

- Rates starting at 6.99% APR

- 80% max LTV for primary residence

- $1,295 origination fee

- Credit score requirements start at 680

Wintrust Mortgage

- Rates starting at 7.25% APR

- 95% max LTV with MI

- $995 origination fee

- Credit score requirements start at 700

CBC Bank

- Rates starting at 6.5% APR

- 80% max LTV

- $595 origination fee

- Credit score requirements start at 660

As you can see, construction loan rates can vary significantly between lenders, so shopping around is crucial. Pay close attention to factors like origination fees, credit score requirements, and loan-to-value limits, as those can also influence your eligibility for the lowest rates.

Preparing Your Construction Loan Application

Once you’ve identified lenders with competitive construction loan rates in Georgia, you’ll need to put together a complete application. Here are some tips:

-

Get pre-approved – this will allow you to lock in a rate early.

-

Know your budget – provide a detailed construction budget with contingencies.

-

Have plans/specs ready – lenders will want to review plans and material lists.

-

Document permit status – show all required permits have been filed.

-

Prove your down payment – have funds verified and seasoned in your accounts

Taking time on the front end to submit a thorough, well-documented application will help ensure a smooth review and approval process.

Alternatives to Consider

While construction loans traditionally offer the lowest rates for building a home, there are a few other options to consider:

Portfolio Loans – some banks offer fixed rate portfolio products for construction at slightly higher rates.

HELOCs – a home equity line of credit can provide funds for a renovation or addition.

203(k) Loans – FHA rehab loans combine purchase and renovation into one mortgage.

Talk to your lender about whether these alternative products may work for your particular project.

Finding the Right Construction Loan Partner

At the end of the day, finding the right lender is just as important as finding the right rate. Look for a lender who specializes in construction lending and has extensive experience funding projects similar to yours. The intricacies of the construction lending process require specialized expertise. Lean on your lender’s knowledge through each step of the build.

With an experienced lender guiding you through the process, a construction loan can be an extremely effective way to build your dream home in Georgia on budget. Take the time to shop around, run the numbers, and compare all the variables that influence your rate and costs. This diligence on the front end will pay dividends as you embark on your new home build.

Special Loans for Construction

JD MORTGAGE® connects you with lenders who want to help you build a new home or renovate an existing property. We find the lenders that offer terms specially tailored to your goals.

Offered exclusively through Biglaw Investor, we make it incredibly simple to find the best loan for your construction financing needs.

Does a Georgia construction loan make sense for you?

If you’re not yet ready to build, you may consider a land/lot loan to secure your piece of property before you commit to a full construction loan.

If you’re not willing to manage the construction process and wait 6-18 months before you can move into your new house, you also might be better off pursuing a traditional mortgage and buying an existing structure.

There used to be a time when getting a construction loan was challenging. Lenders were hesitant to give out money to people who wanted to build homes since there was always the risk that the project would never be completed. But those days are gone. These days, lenders are more than happy to issue construction loans, as long as you can prove that you’re a good credit risk.

Use A Construction Loan To Build A House?

FAQ

What is the lowest down payment for a construction loan?

Are construction loan rates higher than mortgage rates?

What are the requirements for a construction loan in Georgia?

Is it a good idea to get a construction loan?

Does Century Bank of Georgia offer construction loans?

The construction loan product offered by Century Bank of Georgia is unique in that it is available for second homes, vacation homes or investment properties. We contacted them to learn more: When you’re ready to connect with a loan officer, use our form to quickly match with construction loan programs based on your specific circumstances.

Why should you get a new construction loan in Georgia?

We have a network of battle tested construction loan officers with experience overseeing thousands of new homes. There are many benefits in getting a new construction loan in Georgia. The main benefits are that you can choose the land and exact build you want. You also will have a lot of control over the process.

Does Georgia’s own credit union offer a construction loan?

As a not-for-profit financial institution owned by its members, you may find lower fees with a credit union. Recently we asked Georgia’s Own Credit Union to provide us with details on their construction loan and this is what they said: Single-close construction loans for primary residences.

Does CBC Bank offer a construction loan?

CBC Bank is a local bank in Georgia started in 1929 as a state charter bank in Hahira, Georgia. The bank still serves Lowndes County and other areas in southern Georgia. We noticed that CBC Bank offers a construction loan and so we reached out to them to learn more. Here are more details about their construction loan: