Purchasing a condominium can be an attractive option for first-time homebuyers or those looking to downsize. Condos offer lower maintenance than single-family homes and provide amenities like a pool or workout facility. However condos come with their own unique financing requirements, especially when applying for an FHA loan. In this complete guide we’ll explore FHA loan requirements for condos to help you navigate the mortgage process.

What is an FHA Loan?

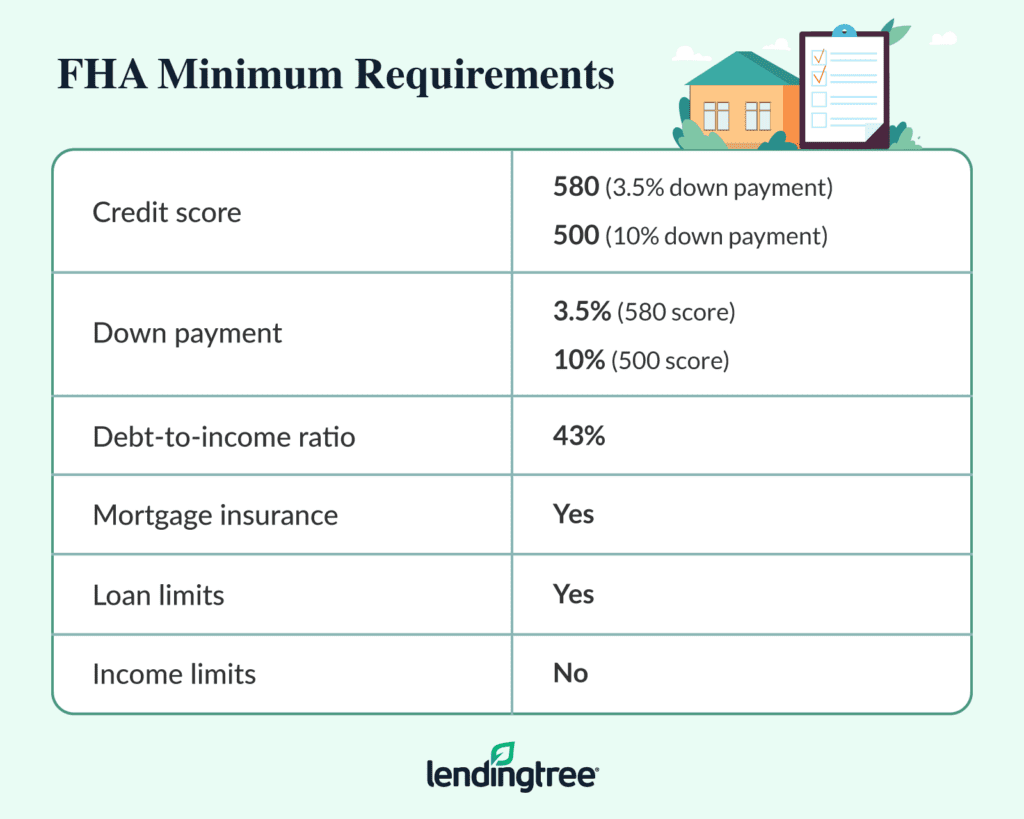

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration (FHA). These loans require lower down payments and credit scores than conventional mortgages making them popular with first-time homebuyers. Here are some key features of FHA loans

- Down payments as low as 3.5% with a credit score of 580 or higher

- More flexible debt-to-income ratio requirements

- Allows gift funds for down payment and closing costs

- Limited cash reserves required

- Mortgage insurance is required

While FHA loans offer more lenient borrowing terms, there are specific property requirements for condos. Let’s look at how condos become FHA approved.

The FHA Condo Approval Process

For a condo to be eligible for FHA financing, the entire project or development must be approved by the FHA. Here is an overview of the approval process:

- The condo association or HOA submits an application with required documentation to HUD. This includes financial statements, insurance policies, and more.

- HUD reviews the condo development to ensure it meets FHA guidelines for finances, owner-occupancy percentage, reserves, and other criteria.

- If approved, the condo project is added to HUD’s list of FHA approved developments and assigned an ID number.

- Condo units within the approved development can now qualify for FHA loans. Approval lasts for 3 years.

New construction and conversions also have specific FHA policies to follow. Additionally, single unit approvals are possible in some cases.

FHA Condo Approval Requirements

For a condo project to gain FHA approval, it must meet certain mortgage eligibility standards. Here are some key FHA condo approval requirements

- Owner-occupancy percentage – At least 50% of units must be owner-occupied as primary residences. No more than 50% combined of units can be rented out or vacant.

- Pre-sales – For new construction, at least 30% of units must be pre-sold or under contract when construction is complete.

- Project completion – The project must be 100% complete, including all construction phases.

- Budget/reserves – At least 10% of the association’s budget must be allocated to replacement reserves for capital expenditures and maintenance.

- Delinquent HOA dues – No more than 15% of unit owners can be over 30 days delinquent on HOA fees.

- Insurance requirements – The HOA must maintain property, liability, fidelity, and flood insurances (if applicable).

- Litigation – Any pending litigation must be disclosed and allowable under FHA guidelines.

- Commercial space – Only 25% of the total project space may be used for commercial purposes.

Meeting all these requirements is essential for FHA condo approval.

FHA Condo Financing Requirements

In addition to development approval, individual condo units and borrowers must meet FHA financing conditions such as:

- Borrower occupancy – You must plan to move into the condo within 60 days as your primary residence.

- Credit score – At least 580 FICO score for 3.5% down payment. Under 580 will require 10% down.

- Down payment – Minimum 3.5% from your own funds. Gifts allowed for remaining amount.

- Mortgage insurance – Required upfront MIP of 1.75% of loan amount plus annual MIP.

- HOA certification – Signed certificate from HOA indicating condo approval status and any restrictions.

Work with your lender to ensure you satisfy all applicable FHA loan requirements for condos.

Finding FHA Approved Condo Projects

The FHA approved condo list is searchable through HUD’s Condominium Approval System. You can look up projects by state, city, name, or ID number. Your real estate agent may also have insight into FHA approved condos in your area.

When viewing listings for condos, look for mentions of FHA approval or eligibility. Ask the seller or HOA to provide the project’s approval documentation. Reviewing the HOA financials and reserve allocation is also wise.

Pros and Cons of FHA Condo Loans

FHA financing offers distinct advantages for purchasing a condo, but also some potential drawbacks.

Pros

- Low 3.5% down payment requirement

- More flexible credit score and debt-to-income qualifications

- Loans available for new construction condos

- Ability to use gifts for down payment and closing costs

Cons

- Monthly mortgage insurance premiums

- Condo project must be approved by FHA

- Not all lenders offer FHA condo financing

- Refinancing into a non-FHA loan may be difficult

Carefully weigh the pros and cons when deciding if an FHA loan is right for your condo purchase.

Alternatives to FHA Condo Loans

If you find an ideal condo that isn’t FHA approved, you may have other financing options:

-

Conventional loans – Require 5-20% down payment but no project approval needed.

-

VA loans – For veterans and service members. No down payment required and limited condo approval.

-

USDA loans – For properties in designated rural areas. 100% financing available.

-

Fannie Mae and Freddie Mac – Have their own condo approval lists separate from FHA.

Discuss these alternatives with your lender to find the most suitable loan for your situation.

Tips for Getting Approved for an FHA Condo Loan

Follow these tips to successfully get approved for an FHA condo mortgage:

- Find an FHA approved condo project in your price range

- Get pre-approved to show sellers you can obtain financing

- Review all HOA rules and documentation for red flags

- Ensure you meet minimum FHA credit score and down payment requirements

- Complete FHA condo certification paperwork with HOA

- Optimize your debt-to-income ratio as much as possible

- Watch out for condo transactions not allowed by FHA like short sales

With proper preparation and diligence, you can overcome the unique hurdles of FHA condo loans.

The Bottom Line

FHA mortgages offer an affordable financing option for purchasing a condo, but interested buyers must navigate condo approval requirements. Ensure the condo development is on the FHA approved registry. Evaluate your personal finances to satisfy credit, income, and down payment guidelines. With extra diligence, you can successfully buy a condo with an FHA loan.

What Is An FHA-Approved Condo?

Your Credit Profile Excellent 720+ Good 660-719 Avg. 620-659 Below Avg. 580-619 Poor ≤ 579

When do you plan to purchase your home? Signed a Purchase Agreement Offer Pending / Found a House Buying in 30 Days Buying in 2 to 3 Months Buying in 4 to 5 Months Buying in 6+ Months Researching Options

Do you have a second mortgage?

Are you a first time homebuyer?

Consent:

By submitting your contact information you agree to our Terms of Use and our Privacy Policy, which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.! NMLS #3030

Congratulations! Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage.

If a sign-in page does not automatically pop up in a new tab, click here

Why Does A Condo Need To Be Approved For An FHA Loan?

Get approved to see what you qualify for.