Buying a home is likely one of the biggest financial commitments you’ll ever make. With so much on the line, you want to make sure you have all the details squared away before signing on the dotted line. That’s where a Quicken Loans mortgage calculator comes in handy.

I’ve used Quicken Loans’ free online mortgage calculators countless times over my 15 years as a real estate agent. I can’t recommend them highly enough for getting a clear picture of your mortgage details so you can shop smarter. In this article, I’ll walk through the key features of their calculator and how it can help you make an informed decision.

An Overview of Quicken Loans’ Mortgage Calculator

Quicken Loans offers a straightforward yet robust suite of free online mortgage calculators Their main calculator covers all the key factors that determine your monthly payments

- Home purchase price

- Down payment amount

- Interest rate

- Loan term

- Estimated property taxes

- Homeowners insurance

- HOA fees

With just those inputs, it quickly calculates your estimated monthly payment broken down by principal, interest, taxes and insurance

The great thing is you can tweak any of those values and immediately see how it impacts your payment. It’s a simple yet powerful way to model different scenarios.

Some key things the Quicken Loans calculator helps you determine:

- How raising or lowering your down payment changes your monthly costs

- Whether a 15 or 30 year term results in more interest savings

- The payment impact if interest rates rise or fall

Beyond the main calculator, they offer additional specialized tools like a refinance calculator, rent vs buy calculator, and amortization calculator.

Key Benefits of Their Mortgage Calculator

Throughout my time as an agent, here are some of the main ways I’ve found Quicken Loans’ calculator useful:

Get a Quick Monthly Payment Estimate

When house hunting, it’s extremely helpful to know your estimated payment range for a certain home price. Their mortgage calculator makes it easy to plug in a purchase price along with estimated taxes, insurance, etc. and get a ballpark monthly payment in seconds.

This gives me a good idea of what price range my clients can comfortably afford. It also helps buyers remain grounded when touring homes listed above their budget.

Compare Loan Terms and Rates

One of the biggest decisions is whether to choose a 15 or 30 year mortgage term. Quicken’s calculator makes it easy to model both options side-by-side for a given home price. You can see the tradeoffs between higher monthly payments with faster payoff versus lower payments but more interest paid over time.

You can also evaluate the impact if you’re able to get a lower rate by bumping up your credit score or down payment. The calculator shows exactly how much your monthly payment decreases for each rate drop.

See the Impact of Changing Your Down Payment

Buyers often want to put down as little as possible. But some conventional loans require at least 3-5% down and rates are lower with 20% down. The calculator shows how raising your down payment amount reduces the monthly costs.

For first-time home buyers, it’s useful to compare an FHA loan (3.5% down) versus conventional loan to see which provides the best terms after considering mortgage insurance.

Estimate Your Refinance Savings

Existing homeowners can use the mortgage calculator to estimate potential monthly savings from refinancing at a lower rate. You plug in your current balance, remaining term, new rate and it shows your new estimated payment.

This makes it easy to determine if the closing costs are worth the long-term savings from a lower rate. Their specialized refinance calculator provides even more details.

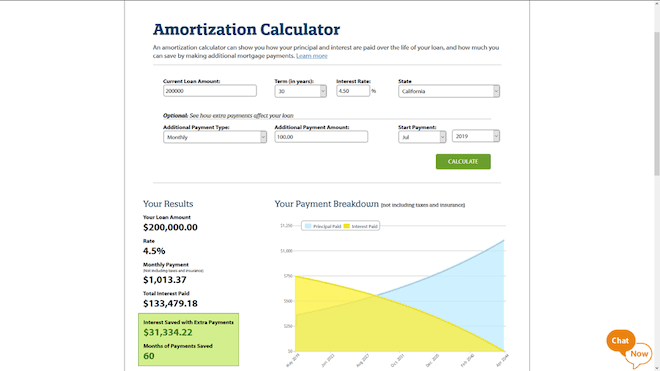

Learn How Extra Payments Reduce Interest

One tip I give my clients is making an extra mortgage payment each year can shave years off your payoff. Quicken’s amortization calculator clearly shows how additional principal payments reduce your interest costs over the loan term.

For motivated borrowers, it can make sense to divert year-end bonuses or tax refunds towards extra mortgage payments. This calculator quantifies the impressive interest savings.

Bottom Line

As a real estate agent, having quick access to an accurate mortgage calculator is indispensible when working with buyers. Quicken Loans’ suite of calculators equips you with all the key information needed to make smart mortgage decisions.

I highly recommend bookmarking their mortgage calculator page. And be sure to play around with different down payments, rates and terms. That will give you a solid grasp of your options before meeting with lenders. A little upfront research goes a long way to making the home buying process smoother.

First-Time Home Buyer Tips

11 Ways To Save For A House: How To Fund Your Down Payment

How To Calculate Your Mortgage Payment

FAQ

How much can you borrow from Quicken Loans?

Is it easy to get a loan with Quicken Loans?

What is the interest rate on a Quicken loan?

|

Loan Option

|

Rate/APR

|

|

30-Year Fixed *

|

7.25% / 7.591%

|

|

15-Year Fixed *

|

6.75% / 7.265%

|

|

VA 15-Year Fixed *

|

6.375% / 7.119%

|

|

VA 30-Year Fixed *

|

6.5% / 6.942%

|

What’s the difference between rocket loans and Quicken Loans?

What is a mortgage calculator?

Our mortgage calculator can help you estimate your monthly mortgage payment. Enter some basic information to get started. Like this estimate? Get your actual numbers by applying online with Rocket Mortgage ®. What’s the purpose of a mortgage calculator? Our mortgage calculator can help you estimate your monthly mortgage payment.

How do I get a home loan estimate?

Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or we’ll estimate the costs based on the state the home is located in.

How do Lenders calculate monthly mortgage payments?

Lenders use a figure called your debt-to-income ratio (DTI) to determine if you’re eligible to buy a house. Your DTI is calculated by dividing the sum of your monthly debts (such as car and credit card payments) by your monthly gross income. Most loans require that your DTI not exceed 45%. How do I calculate my monthly mortgage payment?

What is the refinance calculator?

Our refinance calculator can help you estimate what your monthly payments and loan options might be if you decided to refinance. How do I use the refinance calculator? Start by selecting your refinance goal from the drop-down menu.