Raising capital is crucial for any small business or startup to grow and scale. Beyond bootstrapping or bringing on investors, debt financing through business loans offers an alternative way to fund operations and expansion.

One type of loan commonly used is a 1st lien term loan But what exactly does this entail and is it a good financing option for your company? This guide breaks down key details on 1st lien term loans so you can evaluate if they align with your capital needs and risk tolerance,

What is a 1st Lien Term Loan?

A 1st lien term loan is a secured loan issued by a bank or institutional lender, with the borrower’s assets used as collateral It gets its name because the lender has a “first lien” claim on those pledged assets in case of a default

Some key features include:

- Loan term – Medium-term loans, typically 3-7 years

- Interest rate – Usually a variable rate tied to a benchmark like LIBOR or Prime

- Amortization – May fully amortize or have a balloon payment due at maturity

- Security – Secured by a first claim on the borrower’s assets

- Size – Can range from under $1 million to over $100 million

1st lien term loans are a type of commercial financing used by businesses of all sizes, from small private companies to large corporations, to fund growth and operations.

Comparing 1st Lien Term Loans to Other Financing Options

It helps to understand where 1st lien term loans fit compared to other common small business lending options:

-

Bank lines of credit – Revolving credit lines that can be tapped as needed. Typically variable rates and lower limits. Unsecured.

-

Equipment financing – Funding to purchase specific equipment like machinery or vehicles. Secured only by that equipment.

-

SBA 7(a) loans – Government-backed loans with long terms and fixed rates. Partially guaranteed, so lower risk for lenders.

-

Revenue-based financing – Funding provided in exchange for a % of future revenue rather than fixed payments. Unsecured.

-

Merchant cash advances – Lump sum in exchange for a cut of future credit card sales. Very high effective rates. Unsecured.

-

Venture debt – Specialty financing for startups and growth companies backed by VC/PE investors. May be secured or unsecured.

1st lien term loans differ by providing medium-term secured financing at variable market rates. Lenders can fund larger amounts since the loan is collateralized.

Pros and Cons of 1st Lien Term Loans

Potential Benefits

-

Larger loan amounts – Can access more capital since secured by business assets.

-

Longer terms – Gives more time to repay than short-term loans like credit lines.

-

Clear repayment structure – Set monthly principal and interest payments. Easier to budget vs. lump sums.

-

Variable rates – Interest rate can decrease if benchmark rates fall.

-

Tax deductible interest – Interest expenses can reduce taxable income.

Potential Downsides

-

Collateral required – Must pledge specific business assets which lender could seize in worst case.

-

Prepayment penalties – May face fees if paying loan off early.

-

Rising interest costs – Variable rates could increase payments if underlying rates go up.

-

Reporting requirements – More financial reporting than unsecured loans.

-

Upfront costs – Lender, legal, appraisal fees can be expensive.

-

Restrictive terms – Tighter limits on additional debt, distributions, transactions.

The right fit depends on your specific situation and needs. For some companies, the benefits outweigh the drawbacks.

What Do Lenders Look for When Underwriting 1st Lien Term Loans?

Lenders thoroughly analyze the following areas when deciding to issue a 1st lien term loan:

-

Business viability – Proven concept, strong financials, experienced management.

-

Cash flow – Consistent positive cash flow to make payments. Debt service coverage ratio > 1.2x.

-

Collateral coverage – Assets to secure the loan worth more than loan value.

-

Credit profile – Good business and personal credit history.

-

Term loan purpose – Proceeds used for logical business purposes like growth.

-

Industry dynamics – Competitive advantages and sector stability.

Meeting typical commercial lending standards is crucial given the larger loan sizes and secured nature. Don’t let this deter you from exploring your options though.

What Types of Businesses Use 1st Lien Term Loans?

Since needs and risks vary by industry, 1st lien term loan uses include:

-

Equipment-heavy businesses – Manufacturers, processing plants, heavy machinery companies often use term loans instead of equipment leases or loans. Assets like equipment and real estate provide collateral.

-

Real estate-related businesses – Commercial real estate investors, developers, REITs use term loans for property purchases and construction projects. The real estate secures the debt.

-

Service businesses – Service companies with recurring revenue streams use term loans to fuel expansion. Accounts receivable, IP, or other assets provide security.

-

Tech and biotech firms – Pre-revenue startups use later stage venture debt. When generating revenue, term loans fund growth before eventual IPO. IP and equity pledges provide collateral.

-

Consumer product companies – Term loans allow scaling manufacturing. Inventory, receivables, and wholesale contracts get pledged as collateral.

1st lien term loans offer capital to match long-term growth strategies in many industries. Their secured structure makes them viable for asset-intensive businesses.

What Interest Rates and Fees Are Typical?

Since 1st lien term loans carry lower default risk than unsecured debts, interest rates are generally reasonable. Here are typical costs:

-

Interest rates – Variable rates ranging from Prime + 2.0% to Prime + 6.0% are common, depending on risk, collateral, size, term, and overall conditions. Rates currently start around 7-10%.

-

Upfront fees – Upfront fees of 2-3% of the loan amount help offset origination costs. Legal/appraisal fees may also apply.

-

Prepayment penalties – Loans may have prepayment fees during the first 2-3 years if refinanced or repaid early.

-

Repayment terms – Interest-only with a balloon payment, or fully amortizing terms up to 7 years are typical.

Always model out the full cost of capital across different term lengths and fee structures when comparing lenders. An extra half percent on the rate or year of prepayment penalties makes a notable difference.

Tips for Securing a 1st Lien Term Loan

Follow these tips when seeking a 1st lien term loan to ensure a smooth process:

-

Have a clear business case – Demonstrate market opportunity, financials, management team, and growth prospects.

-

Target reasonable loan amounts – Don’t apply for more than reasonably supported by collateral, cash flow, and use of funds.

-

Accurately appraise and evaluate assets to pledge – Assets must be unencumbered and able to cover loan amount.

-

Gather required financial documents – Tax returns, financial statements, accounts receivable/payable, inventory, etc.

-

Create realistic projections – Forecasts for financials, growth, expenses should be achievable.

-

Check business and personal credit – Know your scores and address any reporting errors in advance.

-

Explore multiple lenders – Compare options from banks, credit unions, specialty finance firms, and peer-to-peer lenders.

-

Negotiate the best rates/terms – Fight for lower rates, longer grace periods, flexible prepayment terms.

With proper preparation and persistence, securing a 1st lien term loan on reasonable terms is doable for many small and mid-sized firms.

Alternatives If You Don’t Qualify for a 1st Lien Term Loan

Don’t get discouraged if you apply and don’t get approved for a 1st lien term loan right now. Consider these alternative debt financing options:

-

SBA loans – Government guaranteed loans like SBA 7(a) or SBA 504 loans have lower borrower requirements.

-

Revenue-based financing – Funding repaid through a percentage of monthly revenue rather than fixed payments.

-

Lines of credit – Tap revolving credit as needed instead of a lump sum term loan.

-

Accounts receivable financing – Borrow against unpaid customer invoices to generate immediate funding.

-

Equipment leasing – Lease production equipment to preserve capital and cash flow.

-

Asset-based loans – Specialty financing using accounts receivable, inventory, machinery, or real estate as collateral.

-

Microlenders – Smaller loans from non-profit lenders focused on underserved businesses.

-

Peer-to-peer lending – Borrow from a pool of investors rather than a bank.

For companies that don’t qualify for a bank-issued 1st lien term loan, these options provide viable alternatives to secure financing.

The Bottom Line

1st lien term loans provide medium-term working capital, funding for equipment purchases, real estate acquisitions, or other growth needs. Their structured payments, variable rates, larger sizes, and collateralization make them useful for many small and mid-sized businesses.

While you give up some flexibility and control compared to unsecured financing options, the benefits may outweigh the drawbacks. Ensure you understand all costs and terms before committing. And realize approval hinges on strong management, finances, projections, and pledged collateral.

With the right preparation and persistence, a 1st lien term loan can provide the injected capital your business needs to take it to the next level. Just approach the process strategically, creatively pursue alternative options if you encounter obstacles, and partner with lenders who best understand your industry and potential.

What is “First Lien/Second Lien Debt”?

First lien and second lien debt are both senior forms of debt, which have equal standing in terms of principal and interest payment but have different standing with respect to the collateral. A lien is a claim on collateral pledged to secure the financing. The first lien debt has the first claim on collateral, while the second lien has a second priority claim. Revolvers, also a form of senior debt, can be secured by their own pool of assets or share collateral with first lien debt.

First lien lenders are often banks but can also be institutional lenders. In contrast, second lien lenders are almost always institutional lenders. An intercreditor agreement, or ICA, usually outlines the terms between lenders. Unitranche facilities can also be bifurcated into first and second lien tranches.

- First lien and second lien debt instruments have different levels of priority against pledged collateral

- First and second lien loans are both secured loans with equal rights in terms of the payment of interest and principal

- First lien lenders are usually banks and second lien lenders are typically institutional investors

In lending, there are two types of subordination: payment subordination, which is the prioritizing of debt according to which tranche has the right to receive interest and principal payments first in case of a default, and lien subordination, which is the prioritizing of debt according to which tranche has the right to the proceeds of liquidated collateral. First and second lien debt are widespread in highly leveraged capital structures that often have one or more tranches of debt secured by the company’s assets. Those tranches of debt can either stake out separate sets of collateral, share the same collateral, or establish priority claims on the collateral. First and second lien debt refers to the priority of their claims on the assets.

Most leveraged capital structures will have first-lien debt in the form of either an amortizing bank loan (term loan A) or a non-amortizing term loan (term loan B or C). If two term loans are present in the same capital structure, term loan A will be considered the first lien as the bank lenders will demand the first claim on the assets. As more companies (and financial sponsors) seek flexibility within the capital structure, term loan As are less common due to their restrictive covenants and cash-intensive amortization schedules. Covenant-lite term loan Bs have become more popular and have assumed the first lien position. This first lien status also supports their use in collateralized loan obligations, adding additional liquidity to the market.

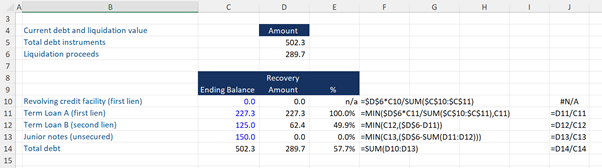

In case of a liquidation, the total liquidation value will be divided among the first lien lenders according to their pro-rata share of the first lien debt. The second lien lenders will share in the remaining proceeds if any.

The following example shows a typical capital structure with 1) an undrawn revolver, 2) First lien term loan A, and 3) second lien term loan B. There are insufficient assets to cover the first and second lien claims, so the second lien will not recover the entire loan. We can see the debt recovery based on the liquidation of assets results in bankruptcy. Access the Excel template to test it yourself.

Since both the term loan A and B are senior in status, it is important to note that both will continue to receive interest and principal payments until a settlement is reached. This highlights the difference between payment subordination and lien subordination and reveals the unique difference between first and second lien debt.

First-lien creditors have a priority claim on assets, while second-lien creditors have a second claim. The priority claim on assets only relates to the disbursement of proceeds when liquidating assets in a bankruptcy. Both creditors are considered pari passu, or on equal footing, regarding their seniority in the capital structure for the payment and repayment of mandatory interest and principal.

CASE and POINT for First Lien HELOCS

FAQ

What is the difference between first and second lien term loans?

What is the first lien position on a loan?

What is the difference between a first lien and a subordinate lien?

What is the recovery rate for first lien loans?

What is first and second lien debt?

First and second lien debt are widespread in highly leveraged capital structures that often have one or more tranches of debt secured by the company’s assets. Those tranches of debt can either stake out separate sets of collateral, share the same collateral, or establish priority claims on the collateral.

When can a lien be claimed?

The timing of when a lien can be claimed depends on the type of lien.For example, commercial construction liens must be filed within 90 days of the last date that a contractor provided materials and/or

Who is a first lien lender?

Usually, the lenders of first lien debt tend to be banks offering senior debt securities such as revolving credit facilities (i.e. “revolvers”) and term loans. The lenders of secured debt are risk-averse and accept lower yields in exchange for a higher claim in the capital structure.

What is first lien debt?

First lien debt refers to a type of secured debt that holds the highest priority in the repayment hierarchy in the event of a borrower default. As stated above, first lien debt refers to a type of secured debt that holds the highest priority in the repayment hierarchy in the event of a borrower default.