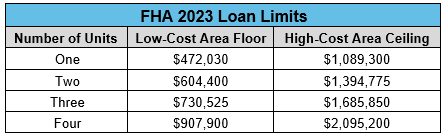

FHA Loan Limits 2023 California is $472,030 and goes up to $1,089,300 for high-cost counties for one-unit properties.FHA Loan Limit 2023 For California for 2-unit properties is $604,400 and goes up to $1,394,775 for high-cost counties.

California has some of the highest home prices in the nation, which means FHA loan limits are critical for homebuyers in the state FHA loans are an attractive option for first-time homebuyers because they require lower down payments and credit scores than conventional mortgages However, FHA places limits on the maximum loan amount based on the county your home is located in.

Understanding the FHA loan limits for 2023 is important if you want to maximize your buying power while taking advantage of FHA benefits. This guide will explain everything you need to know about California FHA loan limits for 2023

What Are the FHA Loan Limits for 2023?

The FHA loan limit refers to the maximum amount you can borrow with an FHA loan. For 2023, FHA has set both national floor and ceiling limits:

- Floor: $472,030

- Ceiling: $1,089,300

The floor sets the minimum loan limit that applies to all low-cost counties nationwide The ceiling is the maximum loan limit used in high-cost counties Each county is assigned a specific dollar limit between these two extremes,

In high-cost metro areas like California, FHA loan limits tend to be much closer to the national ceiling. But even within California, FHA limits can vary widely between different counties and metro areas.

How Are FHA Loan Limits Determined?

FHA loan limits are calculated annually based on changes to the national conforming loan limit set by Fannie Mae and Freddie Mac. Areas where the median home value exceeds 115% of the conforming limit are considered “high cost” and eligible for higher FHA loan limits.

The specific FHA loan limit for each county is set at 65% of the local median home value, with adjustments made to fit within the national floor and ceiling.

As home values increase, FHA will raise loan limits in high-cost counties to provide sufficient buying power. But in lower-cost counties, the floor becomes the de facto limit.

FHA Loan Limits in California for 2023

California is divided into 58 counties, each with its own FHA loan limit based on local home values.

In 2023, FHA loan limits in California range from a floor of $472,030 up to a ceiling of $1,089,300.

-

The floor loan limit applies to 15 mostly rural counties.

-

43 counties have FHA loan limits between the floor and ceiling.

-

10 primarily coastal counties have max loan limits up to the ceiling.

Below are some key details on 2023 FHA loan limits for California:

-

Highest loan limit: $1,089,300 in Alameda, Contra Costa, Los Angeles, Marin, San Francisco, San Mateo, Santa Clara, Santa Cruz and Ventura Counties.

-

Lowest loan limit: $472,030 in Amador, Calaveras, Glenn, Lassen, Modoc, Mono, Plumas, Sierra, Siskiyou, Tehama, Trinity, and Tuolumne Counties.

-

Bay Area counties tend to have higher FHA limits, including Alameda ($1,089,300), Contra Costa ($1,089,300), Marin ($1,089,300), Napa ($881,550), San Francisco ($1,089,300), San Mateo ($1,089,300), Santa Clara ($1,089,300), Solano ($683,250), and Sonoma ($847,500).

-

Southern California FHA limits also tend to be high, such as Los Angeles ($1,089,300), Orange ($1,089,300), San Diego ($946,600), and Ventura ($1,089,300).

-

Central Valley has more moderate FHA limits, like Fresno ($517,000), Kern ($517,000), Kings ($517,000), Madera ($517,000), Merced ($517,000), and Tulare ($517,000).

The full list of 2023 FHA loan limits for every California county can be found on the FHA website. Checking this list is the best way to verify your max loan amount.

High Balance FHA Loans in California

In high-cost counties where the base FHA loan limit falls short, high balance FHA loans can provide increased buying power.

High balance loans are considered for FHA loan amounts between $472,030 and $1,089,300 in eligible areas.

For example, the regular FHA limit in Sacramento county is $753,300. But with a high balance FHA loan, you can borrow up to the $1,089,300 limit.

High balance loans have slightly higher mortgage insurance premiums but otherwise the same terms as standard FHA loans. This makes them an excellent option for pricier markets like California.

Managing Differing FHA Limits When Shopping

One challenge when getting an FHA loan in California is that the max amount can vary drastically between counties. This means as you shop different areas, the FHA limits impact how much home you can afford.

For example, if your budget is $600,000, you could purchase a home with 3.5% down in Sacramento county. But in Contra Costa county your max FHA loan would only be $472,030, requiring a much larger down payment.

When shopping across county lines, you’ll need to research the FHA limits to understand your options. Getting pre-approved for the highest limit you might need is wise. This avoids scrambling for a larger approval letter if you decide to bid on a home in a county with a higher limit.

Connecting with a knowledgeable loan officer can help navigate these nuances when shopping with an FHA loan. They can pull specific limit data and adjust your pre-approval as needed during the home search.

FHA Limit vs. Purchase Price

Another key point is that your FHA loan amount is capped at the lower of either the county loan limit or the purchase price.

For example, if you are buying a home for $650,000 in a county with a $1 million FHA limit, your max loan would still only be $650,000. The limit does not allow you to borrow above the home’s purchase price.

Changes for High Cost Counties in 2023

Based on rising home values, the FHA ceiling limit increased by roughly 7% from $1,017,000 in 2022 to $1,089,300 for 2023. This brings increased buying power to high-cost counties like those throughout California.

However, more expensive areas are also seeing FHA limits bumped from the ceiling down to regular county limits. For 2023, this impacts Mono, Santa Barbara and Santa Cruz counties in California.

While lower than the maximum $1,089,300, the regular FHA loan limits in these counties are still relatively high at $647,200 (Mono), $798,950 (Santa Barbara), and $995,750 (Santa Cruz). So homebuyers will still have significant buying power, just not quite as much as with the ceiling limit.

The FHA Advantage in California

FHA loans remain an attractive mortgage option because they require just 3.5% down and have lower credit score requirements than conventional loans. This helps first-time buyers break into California’s challenging housing market.

But make sure you know the FHA limits for the areas you are house hunting. This allows you to accurately assess the max budget and loan amount you can qualify for.

Connect with a lender early when shopping with FHA financing to get pre-approved and have guidance on navigating county loan limits. This will set you up for success in leveraging FHA to buy a home in high-cost California.

Mortgage Pre-Approval in Minutes

2023 FHA Mortgage Limits for Del Norte County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for El Dorado County

- 1 Unit – $763,600

- 2 Unit – $977,550

- 3 Unit – $1,181,650

- 4 Unit – $1,468,500

2023 FHA Mortgage Limits for Fresno County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Glenn County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Humboldt County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Imperial County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Inyo County

- 1 Unit – $508,300

- 2 Unit – $650,700

- 3 Unit – $786,550

- 4 Unit – $977,500

2023 FHA Mortgage Limits for Kern County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Kings County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Lake County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Lassen County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Los Angeles County

- 1 Unit – $1,089,300

- 2 Unit – $1,394,775

- 3 Unit – $1,685,850

- 4 Unit – $2,095,200

2023 FHA Mortgage Limits for Madera County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Marin County

- 1 Unit – $1,089,300

- 2 Unit – $1,394,775

- 3 Unit – $1,685,850

- 4 Unit – $2,095,200

[rate-quote-middle-cta]2023 FHA Mortgage Limits for Mariposa County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Mendocino County

- 1 Unit – $546,250

- 2 Unit – $699,300

- 3 Unit – $845,300

- 4 Unit – $1,050,500

2023 FHA Mortgage Limits for Merced County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Modoc County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Mono County

- 1 Unit – $693,450

- 2 Unit – $887,750

- 3 Unit – $1,073,100

- 4 Unit – $1,333,600

2023 FHA Mortgage Limits for Monterey County:

- 1 Unit – $915,400

- 2 Unit – $1,171,900

- 3 Unit – $1,416,550

- 4 Unit – $1,760,400

2023 FHA Mortgage Limits for Napa County:

- 1 Unit – $1,017,750

- 2 Unit – $1,302,900

- 3 Unit – $1,574,900

- 4 Unit – $1,957,250

2023 FHA Mortgage Limits for Nevada County:

- 1 Unit – $644,000

- 2 Unit – $824,450

- 3 Unit – $996,550

- 4 Unit – $1,238,500

2023 FHA Mortgage Limits for Orange County

- 1 Unit – $1,089,300

- 2 Unit – $1,394,775

- 3 Unit – $1,685,850

- 4 Unit – $2,095,200

2023 FHA Mortgage Limits for Placer County

- 1 Unit – $763,600

- 2 Unit – $977,550

- 3 Unit – $1,181,650

- 4 Unit – $1,468,500

2023 FHA Mortgage Limits for Plumas County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Riverside County

- 1 Unit – $644,000

- 2 Unit – $824,450

- 3 Unit – $996,550

- 4 Unit – $1,238,500

2023 FHA Mortgage Limits for Sacramento County

- 1 Unit – $763,600

- 2 Unit – $977,550

- 3 Unit – $1,181,650

- 4 Unit – $1,468,500

2023 FHA Mortgage Limits for San Benito County

- 1 Unit – $1,089,300

- 2 Unit – $1,394,775

- 3 Unit – $1,685,850

- 4 Unit – $2,095,200

2023 FHA Mortgage Limits for San Bernardino County

- 1 Unit – $644,000

- 2 Unit – $824,450

- 3 Unit – $996,550

- 4 Unit – $1,238,500

2023 FHA Mortgage Limits for San Diego County

- 1 Unit – $977,500

- 2 Unit – $1,251,400

- 3 Unit – $1,512,650

- 4 Unit – $1,879,850

2023 FHA Mortgage Limits for San Francisco County

- 1 Unit – $1,089,300

- 2 Unit – $1,394,775

- 3 Unit – $1,685,850

- 4 Unit – $2,095,200

2023 FHA Mortgage Limits for San Joaquin County

- 1 Unit – $656,650

- 2 Unit – $840,650

- 3 Unit – $1,016,150

- 4 Unit – $1,262,800

2023 FHA Mortgage Limits for San Luis Obispo County

- 1 Unit – $911,950

- 2 Unit – $1,167,450

- 3 Unit – $1,411,200

- 4 Unit – $1,753,800

2023 FHA Mortgage Limits for San Mateo County

- 1 Unit – $1,089,300

- 2 Unit – $1,394,775

- 3 Unit – $1,685,850

- 4 Unit – $2,095,200

2023 FHA Mortgage Limits for Santa Barbara County

- 1 Unit – $805,000

- 2 Unit – $1,030,550

- 3 Unit – $1,245,700

- 4 Unit – $1,548,100

2023 FHA Mortgage Limits for Santa Clara County

- 1 Unit – $1,089,300

- 2 Unit – $1,394,775

- 3 Unit – $1,685,850

- 4 Unit – $2,095,200

2023 FHA Mortgage Limits for Santa Cruz County

- 1 Unit – $1,089,300

- 2 Unit – $1,394,775

- 3 Unit – $1,685,850

- 4 Unit – $2,095,200

2023 FHA Mortgage Limits for Shasta County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Sierra County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Siskiyou County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Solano County

- 1 Unit – $685,400

- 2 Unit – $877,450

- 3 Unit – $1,060,600

- 4 Unit – $1,318,100

2023 FHA Mortgage Limits for Sonoma County

- 1 Unit – $861,350

- 2 Unit – $1,102,700

- 3 Unit – $1,332,900

- 4 Unit – $1,656,450

2023 FHA Mortgage Limits for Stanislaus County

- 1 Unit – $517,500

- 2 Unit – $662,500

- 3 Unit – $800,800

- 4 Unit – $995,200

2023 FHA Mortgage Limits for Sutter County

- 1 Unit – $488,750

- 2 Unit – $625,700

- 3 Unit – $756,300

- 4 Unit – $939,900

2023 FHA Mortgage Limits for Tehama County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Trinity County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Tulare County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Tuolumne County

- 1 Unit – $472,030

- 2 Unit – $604,400

- 3 Unit – $730,525

- 4 Unit – $907,900

2023 FHA Mortgage Limits for Ventura County

- 1 Unit – $948,750

- 2 Unit – $1,214,600

- 3 Unit – $1,468,150

- 4 Unit – $1,824,550

2023 FHA Mortgage Limits for Yolo County

- 1 Unit – $763,600

- 2 Unit – $977,550

- 3 Unit – $1,181,650

- 4 Unit – $1,468,500

2023 FHA Mortgage Limits for Yuba County

- 1 Unit – $488,750

- 2 Unit – $625,700

- 3 Unit – $756,300

- 4 Unit – $939,900

Los Angeles County FHA loan limit 2023

FAQ

Will FHA limits go up in 2024?

Can you get an FHA loan every 3 years?

What credit score do you need for a FHA loan 2023?

What is the FHA mortgage rate for 2023?

What is the FHA loan limit in California?

To qualify for an FHA loan in California, your home loan must be below the local FHA loan limits in your area. For 2024, the maximum loan limit in California is $498,257 for a single-family home and $2,211,600 for a four-plex. Limits varies by county. The minimum loan limit is $5,000. Loan limits vary by county and home size.

What is the largest FHA loan you can get in 2024?

In 2024, the largest FHA loan someone can get for a single-family home in most parts of the country is $498,257, or 65% of the national conforming loan limit of $766,550. This amount is known as the loan limit “floor.”

How much is a conforming loan in California 2023?

2023 conforming loan limits for California is $726,200 and goes up to $1,089,200 for high-cost counties (aka. high balance mortgage loans) for one-unit properties. Every year Fannie Mae & Freddie Mac, FHA, and the VA revise their California county maximum mortgage limits.

When did FHA release a Mortgagee Letter 2023-21 & 2024 HECM limit?

On November 28, 2023, FHA published Mortgagee Letter 2023-21, 2024 Nationwide Forward Mortgage Limits, and Mortgagee Letter 2023-22, 2024 Nationwide Home Equity Conversion Mortgage (HECM) Limits for case numbers assigned on or after January 1, 2024.