In the fourth quarter of 2023, the average monthly car payment for new cars reached a record-high of $738, a 2. 5% increase from the fourth quarter of 2022. The average car payment for leased vehicles increased at a comparable 2. 4%. However, the average car payment for used vehicles increased by just 0. 4%.

LendingTree looked at payments, originations, term lengths, delinquencies and more to get a full picture of U. S. auto loan debt and trends. Here’s our 2024 roundup of auto loan statistics.

Average Monthly Car Payment in America: $726

In America, the average monthly payment for a new car is $726, based on the most recent Experian data. This represents a 2. 5% increase from the fourth quarter of 2022. For used cars, the average monthly payment is $533, a 0. 4% increase year-over-year.

Factors Driving Up Car Payments

Several factors are contributing to the rise in car payments, including:

- Increased Vehicle Prices: New vehicle prices have increased by 0.7% year-over-year, according to the January 2024 U.S. Bureau of Labor Statistics (BLS) consumer price index.

- Higher Loan Amounts: The average auto loan amount for a new vehicle is $40,366, up from $40,184 in the third quarter. For used cars, the average loan amount is $26,685, down from $27,167 in the previous quarter.

- Longer Loan Terms: The average auto loan term for a new vehicle is 67.9 months, while the average term for a used car is 67.4 months. This means borrowers are taking longer to pay off their loans, resulting in higher total payments.

Auto Loan Debt in America

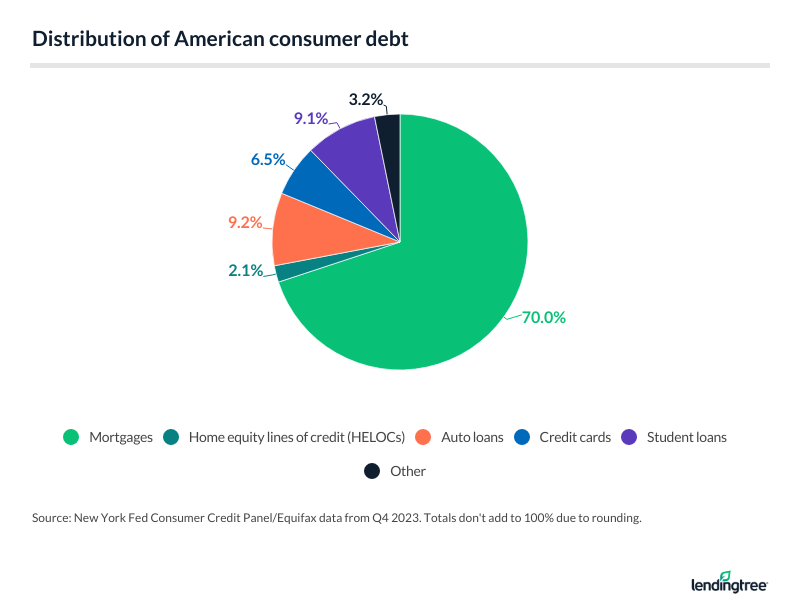

Overall, Americans owe $1.607 trillion in auto loan debt, according to the Federal Reserve Bank of New York. This represents 9.2% of American consumer debt, making it the second-largest category behind mortgages.

Tips for Reducing Your Car Payment

If you’re looking to reduce your car payment here are a few tips:

- Shop Around for the Best Interest Rate: Compare rates from multiple lenders before you take out a loan.

- Make a Larger Down Payment: A larger down payment will reduce the amount you need to borrow, resulting in a lower monthly payment.

- Choose a Shorter Loan Term: Opting for a shorter loan term will mean higher monthly payments, but you’ll pay less interest in the long run.

- Consider a Used Car: Used cars typically have lower monthly payments than new cars.

- Refinance Your Loan: If interest rates have fallen since you took out your loan, you may be able to refinance to a lower rate and save money on your monthly payments.

The average American car payment is on the rise, driven by factors such as increased vehicle prices and higher loan amounts. However there are steps you can take to reduce your car payment and save money. By shopping around for the best interest rate, making a larger down payment choosing a shorter loan term, considering a used car, and refinancing your loan, you can keep your car payment affordable.

Auto loans account for 2% of American consumer debt

While mortgages take the lion’s share of American consumer debt at 70. 0% — according to the New York Fed — auto loans account for 9. 2%. Auto loans and student loan debt both exceeded $1. 600 trillion in the fourth quarter of 2023, with auto loans ($1. 607 trillion) slightly surpassing student loan debt ($1. 601 trillion).

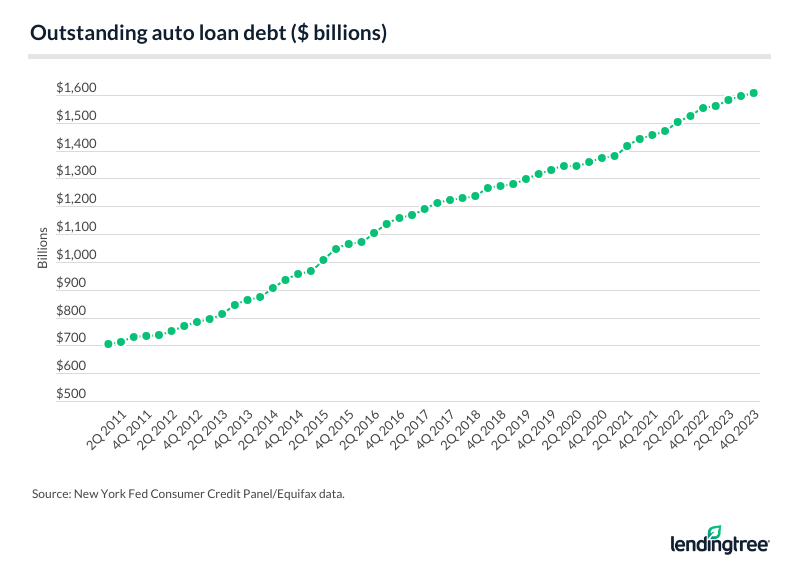

Americans owe $607 trillion in auto loan debt

Overall vehicle debt has increased by 86. 2% between the fourth quarter of 2013 ($863 billion) and the fourth quarter of 2023 ($1. 607 trillion), according to the Federal Reserve Bank of New York.

The only decline during those ten years occurred in the first full quarter of 2020, which coincided with the start of the pandemic.

Average new car loan monthly payment at an all-time high l GMA

FAQ

What is the average car payment in USA?

Is $600 a month a lot for a car?

How much should I spend on a car if I make $100000?

What is a good monthly car payment?

What is the average monthly payment for a new car?

The average car payment for a new vehicle is a record $738 monthly, according to fourth-quarter 2023 data from Experian — up 2.5% year over year. Meanwhile, new lease payments average $606 (up 2.4%). With the lowest jump at 0.4%, used cars have the lowest average monthly payment at $532. Annual changes in average monthly car payments

What is the average monthly car loan payment?

The average monthly car loan payment in the U.S. is $738 for new vehicles and $532 for used ones originated in the fourth quarter of 2023, according to credit reporting agency Experian. It’s worth noting that some recent reports from other industry analysts place the average car payment even higher.

How much does a used car cost a month?

The increase in the average car payment for used vehicles was significantly smaller, at 0.4%. That puts average monthly car payments at $738, $606 and $532, respectively. Increases in new vehicle prices aren’t as severe.

Are Americans paying more to drive a car?

Overall, Americans are paying more to drive their cars these days, whether the vehicle is leased or purchased. The average monthly car payment was $644 for a new vehicle and $488 for used vehicles in the U.S. during the fourth quarter of 2021, according to Experian data. The average lease payment was $531 a month in the same period.